Your CIBIL score is a crucial financial metric that determines your creditworthiness. If you’re an SBI (State Bank of India) customer or planning to apply for an SBI loan or credit card, understanding your SBI CIBIL score is essential.

In this comprehensive guide, we’ll cover:

✔ What is SBI CIBIL Score?

✔ How to Check Your SBI CIBIL Score for Free?

✔ Factors Affecting Your CIBIL Score

✔ How to Improve Your SBI CIBIL Score?

✔ Why a Good CIBIL Score Matters for SBI Loans & Credit Cards?

Let’s dive in!

What is SBI CIBIL Score?

CIBIL Score is a 3-digit number (ranging from 300 to 900) that represents your credit history. It is generated by TransUnion CIBIL, India’s leading credit bureau.

-

900 → Excellent (Best chance of loan approval)

-

750-900 → Good (High approval chances)

-

650-750 → Fair (May face higher interest rates)

-

Below 650 → Poor (Loan rejection possible)

SBI CIBIL Score refers to your credit score as assessed by State Bank of India when you apply for loans or credit cards.

How to Check Your SBI CIBIL Score for Free?

You can check your SBI CIBIL score in multiple ways:

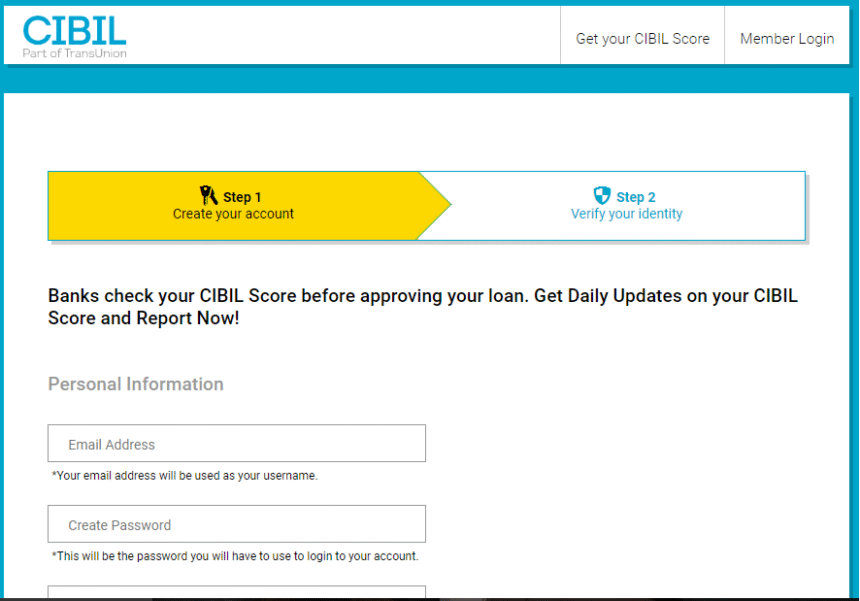

1. Via CIBIL Official Website

-

Visit CIBIL’s official website (Outbound Link 1)

-

Click on “Get Your CIBIL Score”

-

Enter personal & financial details

-

Verify via OTP

-

View & download your report

2. Through SBI Net Banking

-

Log in to SBI Net Banking

-

Navigate to “Credit Score” under loans/credit cards

-

Check your score instantly

3. Via Third-Party Apps (Free & Paid)

-

CRED

-

Paytm

-

BankBazaar

Factors Affecting Your SBI CIBIL Score

Your CIBIL score depends on:

✅ Payment History (35%) – Timely EMI & credit card payments

✅ Credit Utilization (30%) – Keep usage below 30% of limit

✅ Credit Mix (15%) – Healthy mix of secured & unsecured loans

✅ Credit Age (10%) – Longer credit history = Better score

✅ Hard Inquiries (10%) – Too many loan applications hurt score

How to Improve Your SBI CIBIL Score?

If your score is low, follow these proven tips:

1. Pay Bills on Time

-

Set auto-debit for credit card bills & EMIs

2. Reduce Credit Utilization

-

Keep credit card usage below 30% of the limit

3. Avoid Multiple Loan Applications

-

Too many hard inquiries lower your score

4. Maintain a Healthy Credit Mix

-

A balance of secured (home loan) & unsecured (credit card) loans helps

5. Check for Errors in CIBIL Report

-

Dispute inaccuracies via CIBIL dispute resolution

Why Does SBI CIBIL Score Matter?

A good CIBIL score helps with:

✔ Lower Interest Rates – SBI offers better rates for high scorers

✔ Higher Loan Approval Chances – Personal, home, car loans

✔ Premium Credit Cards – Eligibility for SBI Elite, SimplyCLICK

✔ Faster Loan Processing – Less documentation required

Frequently Asked Questions (FAQs)

1. Is CIBIL score free for SBI customers?

-

Yes, SBI provides one free CIBIL report per year via net banking.

2. What is the minimum CIBIL score for an SBI loan?

-

750+ is ideal, but some loans may approve at 650+.

3. How often is CIBIL score updated?

-

Typically updated monthly, depending on lender reporting.

4. Can I get an SBI credit card with a 650 CIBIL score?

-

Yes, but options may be limited. 750+ gets better cards.

Final Thoughts

Your SBI CIBIL score is your financial passport to loans, credit cards, and better banking benefits. By monitoring & improving it, you can unlock lower interest rates, higher limits, and faster approvals.

🔗 Outbound Links for SEO:

Ready to Check Your SBI CIBIL Score?

Visit CIBIL’s website now and take control of your financial health!