Finance Minister Nirmala Sitharaman’s Union Budget 2026 has sought to enhance stability in India’s stock market by increasing the investment limits for NRIs. The government is seeking to draw more money from NRIs in the domestic stock market at a time when Foreign Institutional Investors (FIIs) have been pulling out money in billions of dollars.In her Union Budget speech, Sitharaman announced that the investment cap for persons resident outside India (PROI), which includes Indians living overseas for work, studies or professional engagements and treated as non-residents under the Foreign Exchange Management Act, has been raised to 10% of a company’s paid-up capital from the earlier level. At the same time, the aggregate holding limit for all such investors has been increased to 24% from 10%.Under the revised framework, PROIs, who were earlier limited to foreign direct investment or portfolio investment channels, will now be permitted to hold shares directly in listed Indian companies.

Why is the step important?

Tanvi Kanchan, Associate Director, Anand Rathi Share and Stock Brokers Limited explains that Indians living abroad can now put money directly into Indian listed companies without routing through the cumbersome foreign portfolio investor system. It’s a straightforward move that could unlock billions in fresh capital and the timing matters. Foreign investors pulled out Rs 19 billion from Indian equities in 2025 and another Rs 4 billion in January. By making it easier for the diaspora to invest through the new Portfolio Investment Scheme, policymakers are betting on overseas Indians to provide the stable, long-term capital that institutional investors have increasingly withdrawn.” Tanvi Kanchan tells TOI.She is of the view that this bet makes sense. “Diaspora investors typically hold for the long haul, which steadies markets and reduces volatility. Their participation also strengthens the rupee, improves liquidity, and lowers borrowing costs for Indian companies. When individual investors can take meaningful stakes in businesses, price discovery improves and markets function more efficiently,” she adds.

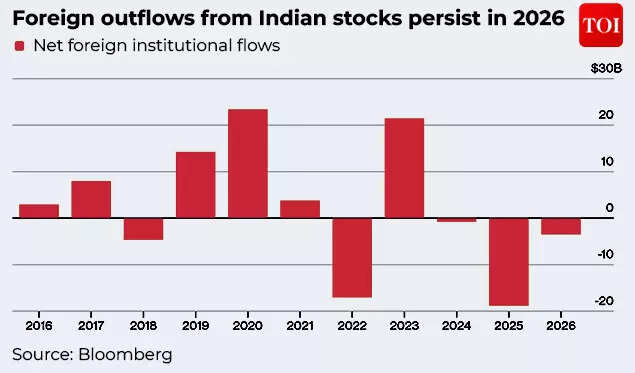

Persistent FII outflows from Indian stock markets

According to Tanvi Kanchan, the potential is significant! “Indian communities across the Middle East, North America, Europe, and Southeast Asia represent enormous wealth seeking reliable growth opportunities. Now they have a straightforward path to participate.Banking, financial services, capital goods, and technology are expected to benefit most. Ultimately, this reform addresses a real problem—building a diversified investor base anchored in long-term commitment rather than volatile global trading flows,” she adds.The move underscores the effort to offset persistent foreign investor outflows by encouraging participation from overseas Indians, whose investments are considered more stable than those of global institutional funds. According to Bloomberg-compiled data, global investors pulled out more than $3 billion in January, following withdrawals of over $18 billion in 2025. These sustained outflows have also weighed on the rupee, which has depreciated 2.3% against the US dollar so far this year, making it the weakest-performing currency in Asia.The policy change may help counter the pressure created by foreign institutional investor withdrawals that have been weighing on the rupee, said Aditya Mulki, chief executive officer at Navi AMC Ltd. He told Bloomberg that non-resident Indians generally invest with a longer time horizon and can provide stability when foreign institutions cut exposure.In anticipation of such inflows, wealth management firms in India have already adjusted their strategies. Over the past two years, several players have set up offices in markets such as Singapore, Dubai and parts of Europe to cater to non-resident Indians, family offices and high-net-worth clients. Alternative investment funds have also increasingly drawn capital from overseas Indians, especially through Gujarat International Finance Tec-City.Sonam Srivastava, founder of Wright Research Portfolio Management Services, said PROI investors usually have enduring personal or economic ties to India, which makes their investments more stable. She added that this kind of capital tends to be less speculative, helping support market liquidity, limit volatility and aid better price formation over time.(Disclaimer: Recommendations and views on the stock market, other asset classes or personal finance management tips given by experts are their own. These opinions do not represent the views of The Times of India)