Property taxes around the U.S. have long been a lightning rod for debate, with political leaders perpetually balancing the need to fund their budget priorities against the risk of alienating homeowners and businesses. This week, for example, New York City Mayor Zohran Mamdani sparked an uproar by proposing to close a budget hole by sharply raising property taxes.

Although the move was widely interpreted as a political gambit aimed at spurring state lawmakers to hike taxes on wealthy New Yorkers and corporations, the backlash highlights the sensitivities around property taxes at a time many Americans already feel financially strapped.

Such taxes — levied mostly by local governments to raise revenue for services including public schools, road construction, and police and fire departments — account for 70 cents of every $1 in local tax collections, according to the nonpartisan Tax Foundation.

But as home values surge nationwide, tax assessments also have risen, leading to higher property taxes in many parts of the U.S. At the same time, states such as Florida, Georgia and North Dakota are taking the opposite tack by proposing to eliminate property taxes for homeowners.

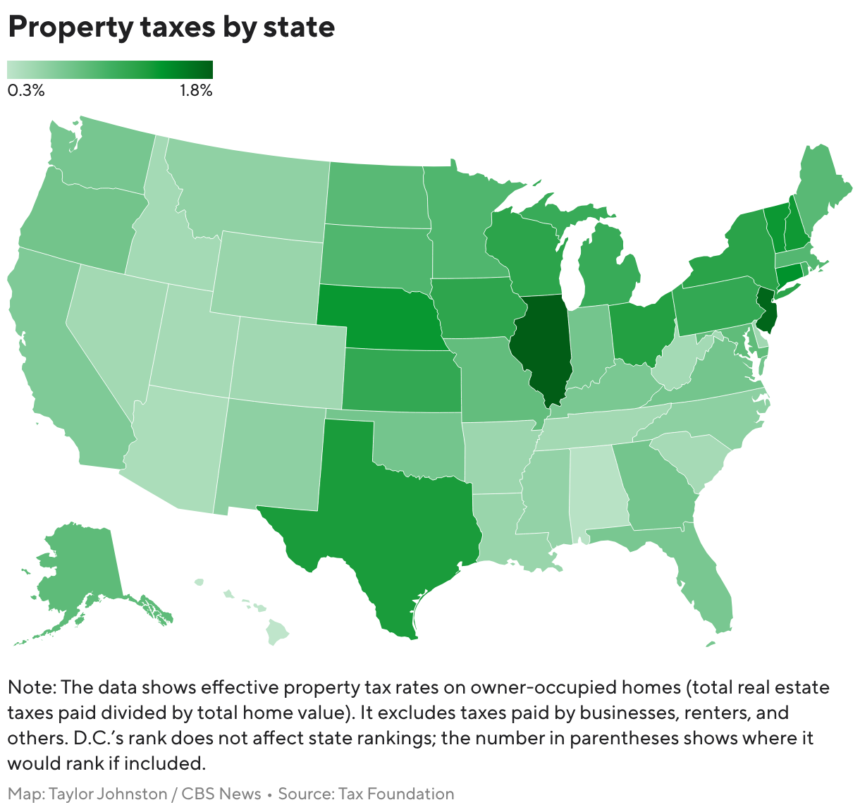

Read on to see how property taxes compare across U.S. states and counties.

“Surging home values have amplified calls to cut or even abolish the property tax,” wrote Tax Policy Center senior research associate Thomas Brosy in a September blog post. “Because property taxes rise with home values, homeowners may fear being squeezed by larger tax bills.”

The median property tax bill in the U.S. jumped 30% between 2019 and 2024, he added. Across the U.S., Illinois has the highest effective property tax rate, while Hawaii has the lowest, according to the Tax Foundation.

Mamdani’s proposal in New York City stems from a $5.4 billion budget shortfall, with the mayor seeking to plug it by either hiking taxes on high-earning residents or raising taxes on homeowners.

That strategem is considered unlikely to succeed. New York Gov. Kathy Hochul has previously rejected a wealth tax and also opposes a higher property tax, while New York City Council Speaker Julie Menin called the plan a non-starter.

New York County, home to Manhattan, is already one of the 16 U.S. counties with the highest median property tax payments, with the typical homeowner paying more than $10,000 per year in property taxes, according to the Tax Foundation.

The other U.S. counties with the highest property taxes include eight in New Jersey, five additional New York counties, Falls Church City in Virginia and Marin County in California.