The Government of India has launched the PM Vidya Lakshmi Yojana 2025. Its objective is to provide education loan facility to students who want to study in India or abroad. Under this scheme, students will get loan for tuition fees and other course related expenses from banks and financial institutions without any guarantee, collateral free for studying in Quality Higher Educational Institutes (QHEIs). Under the Pradhan Mantri Vidya Lakshmi Yojana, the central government provides education loan facility up to Rs 10 lakh without guarantor . Under this, students from families with an annual income of less than Rs 8 lakh will be given education loan up to Rs 10 lakh. The government will give an interest subsidy of 3 percent on this . Any student taking admission in Higher Educational Institution can avail the benefit of Pradhan Mantri Vidya Lakshmi Yojana. Let us tell you how you can apply for PM Vidya Lakshmi Yojana 2024 ?

PM Vidya Lakshmi Scheme 2025

| Name of the scheme | PM Vidya Lakshmi Scheme 2025 |

| Objective | Facility of loan without guarantee to students for higher education |

| Loan Amount | Rs 10 lakh |

| Application Process | Online |

| official website | https://www.vidyalakshmi.co.in |

What is PM Vidya Lakshmi Yojana?

The Union Cabinet on November 6 approved the Pradhan Mantri Vidyalaxmi Yojana (PM Vidyalaxmi Yojana 2025), which aims to cover more than 22 lakh students every year. The government said in its statement that this scheme will provide financial assistance to meritorious students, so that financial difficulties do not prevent anyone from getting higher education. For loans up to Rs 7.5 lakh, the government will provide a credit guarantee of up to 75% on the outstanding loan. This credit guarantee is to assist banks in providing education loans to students under this scheme. Under the Pradhan Mantri Vidyalaxmi Yojana, on taking admission in Quality Higher Education Institution (QHEI), students will be able to get a loan without any guarantee from financial institutions and banks to cover the tuition fees and other expenses related to the syllabus. A simple and transparent system will be created under the Pradhan Mantri Vidyalaxmi Yojana, which will be completely digital.

How to register online for PM Vidya Lakshmi Yojana?

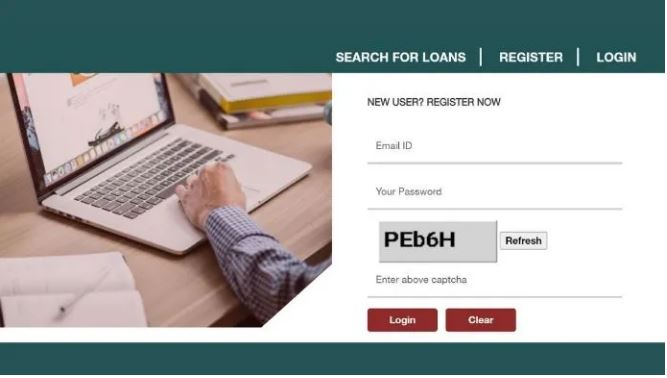

If you want to apply online for Vidya Lakshmi Yojana 2025, then the process is very easy. For this, students will first have to go to the Vidya Lakshmi website and create their new user profile.

Register and create a user account

- Students can click on the New User option on the Vidya Lakshmi portal and then enter the required information to create a new account, i.e., register.

- After registration, a verification link will be sent to the email, by clicking on which they have to activate their account.

Apply for education loan

- After creating an account, students can select the Search and Apply for Loan option. Here they have to choose the country of study (India or Abroad) and select the amount required for their education. That is, how much education loan you want to take.

- After this, students will have to choose three preferred banks and suitable repayment terms.

Submit the form

- After filling all the information, the student has to review all his details and then click on “ Submit ”.

Who is Vidyalakshmi Yojana for?

Any student who enters a Quality Higher Education Institute (QHEI) will be entitled to receive loans from banks and financial institutions to cover tuition fees and other expenses for their higher education under this scheme. Apart from credit guarantee on loans up to Rs 7.5 lakh, students from economically weaker families with annual income up to Rs 8 lakh will get 3% interest subsidy on loans up to Rs 10 lakh. They can avail this benefit only if they are not eligible under any other government scholarship or interest subsidy scheme. This scheme will help students to reduce financial difficulties to continue their studies.

What are the interest rates of PM Vidyalakshmi Yojana (2024)

Under this scheme, 75% credit guarantee will be provided to students on loans up to Rs 7.5 lakh, which will help banks to provide these educational loans. Apart from this, for those students whose annual family income is up to Rs 8 lakh and who are not eligible for any other government scholarship or interest subsidy, 3% interest subsidy will be available on loans up to Rs 10 lakh during the moratorium period. This interest subsidy will be provided to 100,000 students per year, with priority being given to students studying in government institutions and pursuing technical or professional courses. The government has allocated a budget of Rs 3,600 crore for this scheme from 2024-25 to 2030-31 and 7 lakh new students are expected to get the benefit of interest subsidy during this period.

Education Loan Interest Rates by Top 10 Banks

| Bank | interest rate | EMI per Rs 1 lakh |

| State Bank Of India | 8.1% | ₹15,531 |

| Union Bank Of India | 8.1 | ₹15,531 |

| Punjab National Bank | 8.1 | ₹15,531 |

| Bank Of Baroda | 8.15 | ₹15,555 |

| bank of india | 8.35 | ₹15,562 |

| Canara Bank | 8.6 | ₹15,774 |

| Indian Bank | 8.8 | ₹15,871 |

| HDFC Bank | 9.5 | ₹16,216 |

| ICICI Bank | 10.25 | ₹16,589 |

| Axis Bank | 13.7 | ₹18,365 |

EMI calculation is done considering a loan amount of Rs 10 lakh and a tenure of 7 years.

Source: BankBazaar.com

PM Vidya Lakshmi Yojana: Eligibility and Required Documents

The following eligibility and documents are required to apply for Pradhan Mantri Vidya Lakshmi Yojana:

1. Eligibility Criteria

- The applicant must be an Indian resident.

- Applicant must have 12th pass certificate.

- The applicant must have a valid Aadhar card.

2. Required Documents

- Recent passport size photo

- Phone Number

- Income Certificate

What are the benefits of PM Vidya Lakshmi Yojana 2025?

Unsecured Loan: Under this scheme, students can avail a complete loan for their tuition and other related expenses without any guarantee or guarantor.

Credit Guarantee: The government provides a credit guarantee of 75% on loan amount up to Rs 7.5 lakh, making it easier for banks to lend to more students.

Interest subsidy: Students whose family’s annual income is up to Rs 8 lakh will get an interest subsidy of 3% on loans up to Rs 10 lakh during the moratorium period. In this, priority will be given to those students who are pursuing technical or professional courses in government institutions.

Top Points of Pradhan Mantri Vidyalakshmi Yojana

Educational institutions covered under the scheme: The scheme will apply to top Quality Higher Education Institutions (QHEIs) under the National Institutional Ranking Framework (NIRF). It will include all government and private higher education institutions (HEIs) ranked in the top 100 in NIRF’s overall, category-specific and domain-specific rankings. Apart from this, state government HEIs ranked in 101-200 in NIRF and all central government institutions will also be eligible for this scheme.

Annual Update: The list of institutions eligible for this scheme will be updated every year based on the latest NIRF ranking. Currently, 860 QHEIs are covered under the scheme.

Beneficiary Students: More than 22 lakh students are expected to benefit from the scheme, enabling them to avail the benefits of Pradhan Mantri Vidya Lakshmi.

Credit Guarantee: For loans up to ₹7.5 lakh, students can get a credit guarantee of up to 75% of the outstanding amount.

Prime Minister Vidya Lakshmi Scheme: Helpline number

For information related to Pradhan Mantri Vidya Lakshmi Yojana, you can contact 020-2567 8300 or email at

vidyalakshmi@proteantech.in .

FAQs

What is interest subsidy?

Interest subsidy is a part of the loan interest that the government bears to reduce the financial burden on students and their families. Under the Pradhan Mantri Vidya Lakshmi Yojana (PM-Vidyalaxmi), this subsidy will be given through e-vouchers and Central Bank Digital Currency (CBDC) wallets. The subsidy will continue till the moratorium period, which refers to the period until loan repayment has to be started. For example, the moratorium period in SBI education loan can be from six months to one year. Thus, repayment has to be started one year after the completion of the course or six months after getting a job, whichever is earlier.

What are the current interest rates on education loans?

According to Bankbazaar.com, the interest rate on an education loan of Rs 10 lakh starts at 8.1%. At this rate, SBI, Punjab National Bank and Union Bank of India offer education loans with a tenure of seven years. On the other hand, private banks such as ICICI Bank (10.25%) and Axis Bank (13.7%) have comparatively higher interest rates.

Which are the eligible institutions under PM-Vidyalaxmi Yojana?

The scheme will be applicable to top quality higher education institutes (QHEIs) based on the National Institutional Ranking Framework (NIRF). These rankings, released in August 2024, evaluate institutions across various categories such as medical, engineering, law, management and pharmacy.

According to the government, all government and private HEIs ranked in the top 100 in NIRF, institutions with special-category and domain-specific rankings, and state government HEIs ranked 101-200 will be eligible for the scheme. All institutions governed by the central government will also be included. Initially, the scheme will cover 860 eligible QHEIs, which will be able to benefit more than 22 lakh students. This list will be updated every year as per the latest NIRF rankings.

Can students register more than once on Vidyalakshmi Portal?

A student cannot register multiple times on the Vidyalakshmi portal. Students can register only once.

What are the features of Vidyalakshmi Portal?

Vidyalakshmi Portal provides a platform for students where they can access and apply for education loans provided by banks and government scholarships. Its main features are as follows:

- Education loan information from banks

- A common education loan application form for students

- Facility to apply for education loan in multiple banks

- Facility for banks to download student loan application

- Facility for banks to update loan processing status

- Facility for students to send email for complaints and queries related to educational loan

- Link to National Scholarship Portal for information and application of government scholarships

How will I know if my educational loan has been approved?

The bank will update the status of the application on the Vidya Lakshmi portal. Students can check the status of their application on the dashboard of the portal./