PFMS DBT ! Imagine a world where welfare subsidies for food, fuel, and fertilizer reach you directly, without any leaks, delays, or middlemen. A world where a farmer in a remote village receives a scholarship for their child directly into their bank account, or a pregnant woman gets her nutritional assistance without having to navigate a labyrinth of paperwork. This is not a distant utopia; it is the reality being forged in India today by the powerful synergy of two acronyms: PFMS and DBT.

If you’ve ever searched for “pfms dbt,” you’re likely one of millions—a beneficiary checking your payment status, a student tracking your scholarship, or a citizen curious about how your tax money is being utilized. You’ve come to the right place.

This comprehensive guide is your definitive resource on the Public Financial Management System (PFMS) and its cornerstone initiative, Direct Benefit Transfer (DBT). We will demystify the technology, the processes, and the profound impact of this system. We will walk you through every step—from the government’s treasury to your bank account—and equip you with the knowledge to track, verify, and troubleshoot your payments.

Prepare to understand how PFMS DBT is not just a portal but a paradigm shift, transforming governance from the ground up.

1. Decoding the Acronyms: What are PFMS and DBT?

To understand the revolution, we must first understand the revolutionaries. PFMS and DBT are often used interchangeably, but they are distinct entities that work in perfect harmony.

What is DBT (Direct Benefit Transfer)?

Direct Benefit Transfer (DBT) is a flagship scheme of the Government of India launched on 1st January 2013. Its core mission is simple yet radical: to reroute government subsidies and benefits directly into the bank accounts of intended beneficiaries.

Before DBT: Subsidies for LPG, fertilizer, food, etc., were provided indirectly. For example, an LPG cylinder was sold at a subsidized price. This led to several issues:

-

Leakages: Subsidies were often diverted, and “ghost beneficiaries” siphoned off funds.

-

Delays: The benefits took a long time to reach the end-user.

-

Lack of Transparency: It was nearly impossible to track the flow of money.

After DBT: The subsidy amount is transferred directly to the beneficiary’s linked bank account. The citizen buys the product at a market price, and the subsidy is reimbursed. This ensures:

-

Accuracy: Money reaches only the genuine, verified beneficiary.

-

Speed: Digital transfers are near-instantaneous.

-

Transparency: Every transaction can be tracked from source to destination.

What is PFMS (Public Financial Management System)?

If DBT is the “what,” PFMS is the “how.” The Public Financial Management System (PFMS) is the technological platform and the financial network that powers the DBT mission.

Initially started in 2009 as a Central Plan Scheme Monitoring System (CPSMS) to track plan scheme expenditures, it was renamed PFMS in 2015 and given a much broader mandate. It is a web-based, end-to-end solution for processing, tracking, and monitoring the flow of funds to the lowest level of implementation for all government schemes.

Think of PFMS as the central nervous system of the Government of India’s finances. It connects the Treasury of India with the state treasuries, banks, and the Reserve Bank of India (RBI), creating a seamless financial network.

The Symbiotic Relationship: Why PFMS is the Backbone of DBT

PFMS and DBT are inseparable. PFMS provides the essential infrastructure for DBT to function:

-

Beneficiary Database: PFMS maintains a central, verified database of beneficiaries for various schemes, which is crucial for identifying the right recipients.

-

Payment Gateway: It acts as a mega payment gateway, processing millions of transactions simultaneously to bank accounts across the country.

-

Tracking and Monitoring: It provides a real-time dashboard for government departments to monitor the status of every single payment, enabling proactive grievance resolution.

-

Integration Hub: PFMS integrates with other critical systems like the Aadhaar database, the National Payments Corporation of India (NPCI), and core banking systems of hundreds of banks.

Without PFMS, DBT would be a policy without a pipeline. PFMS is the pipeline that ensures the lifeblood of welfare reaches its destination.

2. The Architectural Marvel: How the PFMS DBT Ecosystem Works

The PFMS DBT system is a masterpiece of digital public infrastructure. Let’s break down its components and the payment journey.

The Core Components of PFMS

The system is built on several interconnected modules:

-

Payment and Accounting Module: The heart of the system, handling all financial transactions and maintaining real-time accounting.

-

Scheme Management Module: Allows government departments to configure and manage their specific DBT schemes, define eligibility, and set payment rules.

-

Beneficiary Management Module: Handles the registration, verification, and validation of beneficiaries, including Aadhaar seeding.

-

Grievance Redressal Module: Integrated with the Centralized Public Grievance Redress and Monitoring System (CPGRAMS) to address payment-related complaints.

-

Reporting and Dashboard Module: Provides comprehensive analytics and real-time reports for administrators and the public.

**The Step-by-Step Journey of a DBT Payment

Let’s trace the path of a single scholarship payment from the government to a student:

-

Initiation: The Ministry of Education releases funds for a scholarship scheme. The details of eligible students are uploaded to the PFMS platform via the National Scholarship Portal (NSP), which is integrated with PFMS.

-

Authentication & Validation: PFMS cross-verifies the student’s details. It checks if the student’s bank account is linked with their Aadhaar number (a process called Aadhaar seeding). This is a critical step.

-

Payment Instruction: Once validated, PFMS generates a payment instruction file. This file contains the beneficiary’s bank account details (via Aadhaar) and the amount to be paid.

-

Routing via NPCI: This payment file is sent to the National Payments Corporation of India (NPCI). The NPCI acts as a central switch. It uses the Aadhaar number to find the beneficiary’s bank through its Aadhaar Payment Bridge (APB).

-

Bank Processing: The NPCI routes the payment instruction to the specific bank where the beneficiary holds an Aadhaar-linked account.

-

Credit to Account: The beneficiary’s bank processes the instruction and credits the amount to the student’s account.

-

Confirmation: The bank sends a confirmation back to the NPCI, which is then relayed to PFMS. The status on the PFMS portal is updated to “Paid.”

-

Notification: In many cases, the beneficiary receives an SMS alert on their registered mobile number confirming the credit.

This entire process, involving multiple giant systems, often completes in a matter of hours, showcasing the incredible efficiency of the PFMS DBT architecture.

3. A Deep Dive into the PFMS Portal: Navigation and Key Features

The public face of this complex system is the user-friendly portal https://pfms.nic.in. Let’s explore its key sections.

(Image Prompt: An annotated screenshot of the PFMS.nic.in homepage, with clear labels pointing to the “Know Your Payment” link, the “Track NSP Payment” link, and the “List of DBT Schemes” link.)

-

For Citizens/Beneficiaries:

-

Know Your Payment: This is the most used feature. It allows you to track your payment status using your bank account number or PFMS DBT ID.

-

Track NSP Payment: A dedicated section for students to track scholarships from the National Scholarship Portal.

-

List of DBT Schemes: Provides a comprehensive list of all government schemes that are routed through the DBT mechanism.

-

-

For Other Stakeholders:

-

Agency Login: For government departments and agencies to log in, manage schemes, and initiate payments.

-

State Login: For state government officials to access their respective modules.

-

Bank Login: For banking partners to interface with the system.

-

4. For the Citizen: Your Practical Guide to PFMS DBT

This is the section you’ve been waiting for. Let’s get practical.

How to Check Your PFMS DBT Payment Status (Step-by-Step Guide)

Checking your payment status is straightforward. Follow these steps:

-

Visit the Official Portal: Go to

https://pfms.nic.in. -

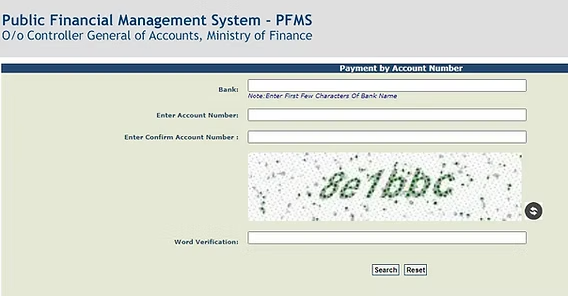

Navigate to ‘Know Your Payment’: On the homepage, under the “Citizens” section, click on the “Know Your Payment” link.

-

Select Search Criteria: You will be presented with a search box. You can search by:

-

Bank Account Number: The most common method.

-

PFMS DBT ID/Payment Reference Number: If you have been provided one.

-

-

Enter Details: Enter your bank account number and the captcha code.

-

View Results: Click “Search.” A new page will display all DBT transactions made to that account number.

-

Scheme Name: Which scholarship or subsidy you received.

-

Amount: The exact amount credited.

-

Payment Date: The date the transaction was processed.

-

Status: “Paid,” “In Process,” or “Failed.”

-

PFMS DBT ID/Payment Reference No.: A unique identifier for that transaction.

-

How to Search by PFMS DBT ID or Payment Reference Number

If you have a specific PFMS DBT ID (e.g., from a grievance ticket or an application acknowledgment), you can use the same “Know Your Payment” section. Select the “PFMS DBT ID” option from the dropdown, enter the ID, and search. This will give you a precise result for that single transaction.

Understanding Different Payment Statuses

-

Success/Paid: The payment has been successfully credited to your bank account. You should also see it in your bank statement.

-

In Process: The payment has been initiated by the department but is still being processed by the banks or the NPCI. Check back after 24-48 hours.

-

Failed: The payment could not be completed. This requires your attention (see next section).

Common Reasons for PFMS DBT Payment Failure and Solutions

A “Failed” status can be frustrating, but it’s usually fixable. Here are the most common reasons:

-

Aadhaar Not Mapped/Seeded with Bank Account: This is the #1 reason. Your Aadhaar number must be linked to the bank account you provided.

-

Solution: Visit your bank branch and ensure your Aadhaar is correctly seeded with your account. You can also check this linkage online via your bank’s net banking portal or the UIDAI website.

-

-

Bank Account Inactive/Closed: If the account is dormant or has been closed, the payment will be rejected.

-

Solution: Reactivate your dormant account or provide active bank account details to the scheme authorities.

-

-

Name Mismatch: If the name in the scheme application does not exactly match the name on your bank account, the bank may reject the transaction.

-

Solution: Ensure consistency in your name across all documents—Aadhaar, bank account, and scheme application. Use the full name as per the bank record.

-

-

Incorrect Bank Account Number/IFSC Code: A simple typo can cause failure.

-

Solution: Double-check the account details you submitted and correct them if necessary by contacting the scheme helpline.

-

If your payment has failed, the amount is returned to the government department. They will typically try to re-initiate the payment once the issue is resolved. You should also raise a grievance on the PFMS portal or the specific scheme portal.

5. The Big Picture: Impact and Benefits of the PFMS DBT System

The PFMS DBT combo is more than a technical upgrade; it’s a socio-economic game-changer.

-

Elimination of Leakages and Ghost Beneficiaries: By transferring money directly to authenticated individuals, the system has wiped out millions of fake beneficiaries. For instance, in the LPG subsidy scheme (PAHAL), over 3.5 crore duplicate/ghost connections were weeded out, saving tens of thousands of crores for the exchequer. According to a report by the World Bank, DBT has been instrumental in improving the efficiency of social protection programs in India.

-

Enhanced Transparency and Accountability: Every rupee is now traceable. A citizen can see if a payment was made, and an official can see if it was received. This has significantly reduced corruption and increased trust in the system.

-

Massive Fiscal Savings: The government has saved an estimated ₹2.5 lakh crore (over $30 billion) as of 2023 through the DBT mechanism across various schemes. This is money that can be reinvested in other development projects.

-

Empowerment and Financial Inclusion: DBT has been a driving force behind the “Jan Dhan” (mass banking) movement. To receive benefits, people opened bank accounts, bringing them into the formal financial system. This empowers them, especially women, by giving them direct control over the funds.

6. Beyond the Hype: Challenges and the Road Ahead for PFMS DBT

No system is perfect, and PFMS DBT has its own set of challenges.

-

Digital Divide: A segment of the population, particularly in remote areas, still lacks the digital literacy or connectivity to easily track payments or resolve issues online.

-

The Last-Mile Hurdle: While Aadhaar seeding is high, ensuring 100% accuracy and handling edge cases (like name mismatches) remains a persistent challenge.

-

Grievance Redressal: While integrated, the grievance resolution process can sometimes be slow, leaving beneficiaries in a state of uncertainty when a payment fails.

The Future Roadmap: The government is continuously working to improve the system. The future lies in:

-

Expanding the DBT Universe: Including more and more schemes under its umbrella.

-

DBT 2.0: Focusing on “real-time” benefit transfers and more sophisticated targeting.

-

Enhanced Interoperability: Making the system even more seamless with other digital public goods like UPI and Account Aggregators.

7. Frequently Asked Questions (FAQs) on PFMS DBT

Q1: Is PFMS and DBT the same thing?

A: No. DBT (Direct Benefit Transfer) is the policy or the scheme to send benefits directly to bank accounts. PFMS (Public Financial Management System) is the primary technological platform and payment gateway used to implement the DBT scheme.

Q2: I have a PFMS DBT ID, but my payment status is ‘In Process’ for over a week. What should I do?

A: “In Process” means the payment is moving through the pipeline. If it’s stuck for over 7-10 working days, it could indicate a minor holdup at the bank. Wait for a few more days. If it doesn’t change, note down your PFMS DBT ID and raise a grievance on the portal or contact the helpline of the specific scheme.

Q3: My Aadhaar is linked to my bank account, but the payment still failed. Why?

A: The most likely reason is a name mismatch. The name in the scheme application must match the name in your bank records exactly. For example, if your bank account has “Ramesh Kumar” but the application says “Ramesh Kumar S,” it may fail. Contact your bank and the scheme provider to synchronize the details.

Q4: Can I get a list of all DBT payments made to me?

A: Yes. Using the “Know Your Payment” search by your bank account number will show you a complete history of all DBT transactions credited to that account.

Q5: Where can I learn more about the technical architecture of PFMS?

A: The official PFMS website has detailed documentation. For a global perspective on how such systems work, you can refer to resources from the International Monetary Fund (IMF) on Public Financial Management.

8. Conclusion: PFMS DBT – A Model for the World

The PFMS DBT story is a testament to India’s ambition to harness technology for public good. It is a complex, large-scale engineering project that has touched the lives of hundreds of millions, ensuring that welfare is not just a promise on paper but a tangible deposit in a citizen’s bank account.

It has plugged leaks, empowered the marginalized, and saved precious public resources. While challenges around last-mile connectivity and grievance resolution persist, the direction is clear and the progress is undeniable.

The next time you search for “pfms dbt,” you are not just tracking a payment; you are witnessing a silent digital revolution that is redefining the social contract between the citizen and the state. The PFMS DBT model is now being studied by countries around the world as a blueprint for efficient, transparent, and accountable governance. It is, truly, a Indian success story for the digital age.