HDFC Bank NetBanking Login : In today’s fast-paced digital world, managing your finances should be effortless, secure, and available at your fingertips. For millions of Indians, the gateway to this convenience is the HDFC Bank Login portal. Whether you’re checking your account balance, transferring funds, paying bills, or applying for a loan, it all begins with a successful and secure login.

However, navigating the login process, troubleshooting common errors, and ensuring your account’s security can sometimes be daunting. This comprehensive guide is your one-stop resource for everything related to HDFC Bank NetBanking Login and Mobile Banking Login. We will walk you through the entire process, from registration to advanced features, and equip you with the knowledge to bank online with absolute confidence.

1. Why HDFC NetBanking and Mobile Banking are Essential

Gone are the days of waiting in long queues at the bank for every small transaction. HDFC Bank’s digital platforms are designed to give you complete control over your finances 24/7, 365 days a year. Here’s why logging in becomes a part of your daily routine:

-

24/7 Accessibility: Check your account balance, view mini-statements, and track transactions anytime, from anywhere in the world.

-

Fund Transfer: Seamlessly transfer money to your own accounts, to other HDFC Bank accounts, or to accounts in over 100 other banks via NEFT, RTGS, or IMPS. IMPS transfers are instant, even on holidays.

-

Bill Payments and Recharges: Pay your electricity, water, gas, credit card, and insurance bills in seconds. Recharge your mobile, DTH, and data cards effortlessly.

-

Investments and Insurance: Apply for IPOs, invest in Fixed Deposits (FDs), Recurring Deposits (RDs), and purchase insurance policies directly from the portal.

-

Loan Management: Apply for personal loans, home loans, or car loans with pre-approved offers. You can also track your existing loan application and view your loan statement.

-

(Outbound Link 1: To provide context on loan services, we will link to HDFC’s official loan page: https://www.hdfcbank.com/personal/borrow/popular-loans/personal-loan)

-

-

Credit Card Services: Apply for new cards, pay your credit card bill, view statements, redeem reward points, and activate offers.

-

Security: With features like two-factor authentication, secure PINs, and biometric login, your transactions are far more secure than a paper-based trail.

2. Prerequisites for HDFC Bank Login

Before you begin the login process, ensure you have the following:

-

A Valid HDFC Bank Account: You must have a savings, current, or salary account with HDFC Bank.

-

Customer ID: This is your unique identification number provided by HDFC Bank. You can find it on your welcome kit, cheque book, account statement, or through an SMS from the bank.

-

Registered Mobile Number: Your mobile number must be linked to your bank account to receive crucial OTPs (One Time Passwords) for authentication and alerts.

-

Internet Connection: A stable and secure internet connection is required for both NetBanking and Mobile Banking.

-

Login Password (IPIN): For NetBanking, this is the password you set during registration. For the mobile app, you can use a password or a secure MPIN.

-

For NetBanking: A computer or laptop with a recommended web browser (Chrome, Firefox, Safari, Edge).

-

For Mobile Banking: A smartphone (Android or iOS) to download the official “HDFC Bank MobileBanking” app.

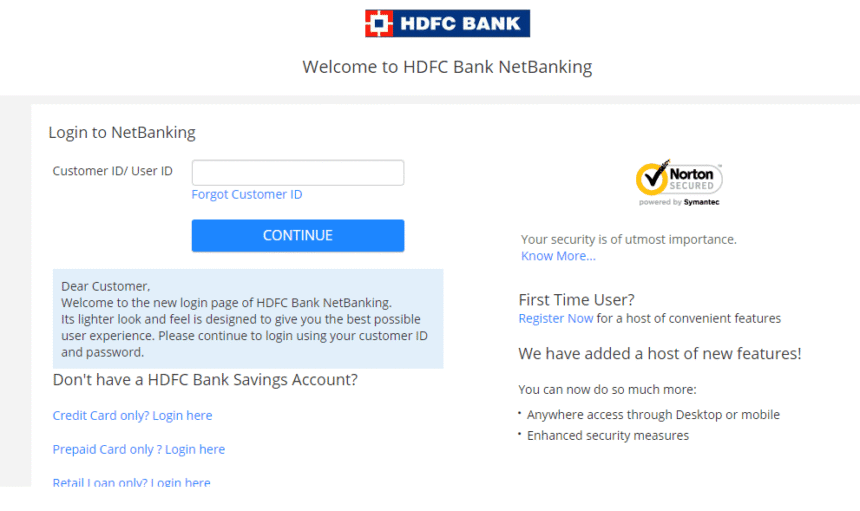

3. A Step-by-Step Guide to HDFC NetBanking Login

How to Login for the First Time

If you are a new user and have received your Customer ID but have not yet set up your NetBanking password, follow these steps:

-

Go to the official HDFC Bank NetBanking login page: https://netbanking.hdfcbank.com/netbanking/

-

Enter your Customer ID and click ‘Continue’.

-

On the next page, click on the “Forgot Password?” link.

-

You will be asked to validate your identity. You can do this by using your Debit Card details (card number, expiry date, and ATM PIN) or by receiving an OTP on your registered mobile number.

-

Once validated, you will be prompted to set a new, strong password for your NetBanking account (your IPIN).

-

After successfully setting the password, you will be redirected to the login page. Enter your Customer ID and the new password to access your account.

Regular Login Process

For existing users, the process is straightforward:

-

Enter your Customer ID and click ‘Continue’.

-

On the next screen, enter your NetBanking Password (IPIN).

-

You will likely be asked to enter a OTP sent to your registered mobile number or a characters from your Secure Access Word for added security.

-

After successful validation, you will be logged into your secure NetBanking dashboard.

4. A Step-by-Step Guide to HDFC MobileBanking Login (App)

(Image Prompt: A modern smartphone displaying the HDFC Bank MobileBanking app’s login screen, showing the options for Customer ID login and Quick Access PIN/Biometric login.)

The HDFC Bank MobileBanking app offers all the features of NetBanking with the added convenience of mobility and quicker login methods.

Downloading and Installing the App

-

Open the Google Play Store (for Android) or the App Store (for iOS).

-

Search for “HDFC Bank MobileBanking”.

-

Ensure the developer is “HDFC Bank” and download the official app.

-

Install the app on your phone.

First-Time Login and Registration

If you are already registered for NetBanking, you can use the same credentials for the app.

-

Open the HDFC Bank app.

-

Tap on “Login using Customer ID”.

-

Enter your Customer ID and Password (IPIN).

-

Authenticate the login with the OTP sent to your registered mobile number.

-

Once logged in, you will be prompted to set a 4-digit MPIN or register your biometric ID (fingerprint/Face ID) for future quick logins.

Using Quick Access PIN/Biometric Login

After setting it up, logging in becomes incredibly fast:

-

Open the HDFC Bank app.

-

Instead of entering your Customer ID, you can simply enter your 4-digit MPIN.

-

Alternatively, if you’ve registered biometrics, just tap the “Quick Access” button and use your fingerprint or face recognition to instantly access your account. This combines supreme convenience with high-level security.

5. What To Do If You Forget Your Login Credentials

It happens to the best of us. Here’s how to recover your credentials quickly.

Forgot Customer ID?

Your Customer ID is not a secret like your password. You can find it:

-

On your HDFC Bank welcome letter or account statement.

-

On your cheque book (it’s printed above the account number).

-

By calling HDFC Bank customer care.

-

By visiting your home branch and asking an executive.

Forgot IPIN/Password?

This is a common issue and is easily resolved online:

-

On the NetBanking login page, click “Forgot Password?”.

-

Enter your Customer ID and confirm the text in the captcha.

-

Choose your verification method: Debit Card Details or OTP on Registered Mobile.

-

If using a debit card, enter the last 4 digits of your card number, the expiry date, and your ATM PIN.

-

If using OTP, enter the code sent to your mobile.

-

Once verified, you will be guided to create a new, strong password.

Forgot Mobile Banking MPIN?

If you forget your MPIN, you cannot recover it. You must reset it:

-

Open the Mobile Banking app.

-

On the MPIN login screen, tap on “Forgot MPIN?”.

-

You will need to log in again using your Customer ID and NetBanking Password and authenticate with an OTP.

-

After successful login, you can set a new 4-digit MPIN.

6. How to Register for HDFC NetBanking & Mobile Banking

Online Registration (Self-Registration)

You can register for NetBanking online if you have your account details handy:

-

Go to the NetBanking login page and click on “New User? Register Here” or “First Time User”.

-

You will need to provide your Customer ID, Account Number, Debit Card Number, and ATM PIN for validation.

-

You will also need your registered mobile number to receive an OTP.

-

Follow the on-screen instructions to set your IPIN and complete the registration.

Branch Registration

If you face any issues with online registration or prefer in-person help, you can visit your home branch. Fill out the NetBanking registration form, submit a copy of your ID proof, and the executive will enable the service for you. You will receive your Customer ID and a temporary password to log in for the first time.

7. Advanced Login Security: Stay Safe Online

With great convenience comes great responsibility. Here’s how to ensure your HDFC Bank login remains secure:

-

Recognize Phishing Attacks: HDFC Bank will NEVER call, email, or SMS you asking for your Customer ID, Password, ATM PIN, CVV, or OTP. Beware of fake emails and websites that look like HDFC’s. Always check the URL—the official website is always

https://www.hdfcbank.com/orhttps://netbanking.hdfcbank.com/.-

*(Outbound Link 2: To educate users on cybersecurity best practices, we will link to a reputable external source: The Indian Computer Emergency Response Team (CERT-In) guidelines: https://www.cert-in.org.in/)*

-

-

Use Secure Networks: Avoid logging into your NetBanking account using public Wi-Fi networks (e.g., at cafes, airports). Use a secure, private Wi-Fi connection or your mobile data network.

-

Create Strong Passwords: Use a unique, complex password for NetBanking that includes uppercase letters, lowercase letters, numbers, and special characters. Do not use easily guessable information like your name or date of birth.

-

The Importance of Logging Out: Always explicitly log out of your NetBanking session when you are done. Simply closing the browser tab may not terminate your session immediately.

-

Monitor Your Accounts: Regularly check your account statements and set up transaction alerts to be notified of any unauthorized activity immediately.

8. Troubleshooting Common HDFC Login Issues

-

“Invalid Customer ID or Password” Error: Double-check that your CAPS LOCK key is off. The password is case-sensitive. Ensure you are not confusing your Customer ID with your account number.

-

Account Locked Due to Multiple Failed Attempts: For security, your account gets locked after a few incorrect login attempts. You will need to use the “Forgot Password” feature to unlock it by resetting your password.

-

“Session Expired” Error: This happens due to inactivity for a certain period. This is a security feature. Simply refresh the page and log in again.

-

OTP Not Received: Check if your mobile number is correctly registered with the bank and has a strong signal. Ensure you have not activated DND (Do Not Disturb) services for transactional SMSes. If the problem persists, contact customer care.

-

App Not Working or Crashing: Ensure your app is updated to the latest version from the Play Store or App Store. Try restarting your phone. If the issue continues, uninstall and reinstall the app.

9. Beyond Login: Exploring the Powerful Features

Once you successfully complete your HDFC Bank login, a world of financial services opens up. The dashboard is intuitively designed, but here are some highlights:

-

Funds Transfer: Easily navigate to “Funds Transfer” to add beneficiaries and start transferring money via NEFT, RTGS, or IMPS.

-

BillPay: A dedicated section where you can view and pay all your bills in one place.

-

Invest: Explore and book Fixed Deposits (FDs) at competitive rates in just a few clicks.

-

Loans: Check your pre-approved loan offers and apply for them instantly without any documentation. This is a seamless process post-login.

-

Cardless Cash Withdrawal: Use the app to generate a code for withdrawing cash from an HDFC ATM without using your debit card.

-

Instant Credit Card: Get your credit card approved and issued instantly based on your eligibility.

(Outbound Link 3: To provide information on the broader digital payments ecosystem in India, we can link to the National Payments Corporation of India (NPCI) website, which oversees UPI, IMPS, etc.: https://www.npci.org.in/)

10. Frequently Asked Questions (FAQs)

Q1: Is there a charge for using HDFC NetBanking or Mobile Banking?

A: No, HDFC Bank does not charge any fee for registering or using its NetBanking and Mobile Banking services. However, standard transaction charges (like for NEFT/RTGS) may apply as per the bank’s schedule.

Q2: Can I access NetBanking from abroad?

A: Yes, you can access HDFC NetBanking from anywhere in the world. However, for security reasons, certain transactions may be restricted on international networks, and roaming charges from your telecom provider may apply.

Q3: My registered mobile number has changed. How do I update it?

A: You cannot update your mobile number online for security reasons. You must visit your home branch with a proof of identity and address and fill out a form to get your mobile number updated. This is crucial for receiving OTPs.

Q4: What is the difference between the IPIN and MPIN?

A: Your IPIN is your password for logging into the NetBanking website. It is typically longer and alphanumeric. Your MPIN is a 4-digit numeric PIN used for quick login to the Mobile Banking app.

Q5: Who do I contact if I face a technical issue?

A: You can call the HDFC Bank customer care helpline (1800-202-6161 / 1800-257-3333) for assistance. You can also use the “Contact Us” section within the NetBanking portal or mobile app.

11. Conclusion: Banking at Your Convenience

Mastering your HDFC Bank login is the first and most important step towards unlocking a seamless and powerful banking experience. The digital platforms are designed to save you time and give you unparalleled control over your financial life. By following the steps and security tips outlined in this guide, you can ensure that your journey with HDFC NetBanking and Mobile Banking is not only convenient but also completely secure.

Embrace the future of banking. Log in today and discover how easy managing your money can be.

Disclaimer: This blog post is intended for informational purposes only. The features, processes, and interfaces of HDFC Bank’s digital platforms are subject to change. For the most accurate and up-to-date information, please always refer to the official HDFC Bank website (https://www.hdfcbank.com/) or contact their customer support directly.