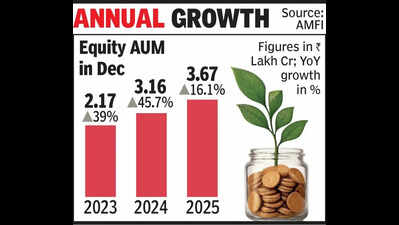

Ahmedabad: Gujarat’s equity mutual fund assets under management (AUM) clocked their slowest annual growth in three years in 2025. Data from the Association of Mutual Funds in India (AMFI) shows that equity AUM in the state rose 16.1% year on year to Rs 3.67 lakh crore in Dec 2025, a sharp deceleration compared to 45.7% growth in 2024 and 39% in 2023. The last comparable slowdown was recorded in 2022, when equity AUM grew 16.6%.Market participants said the moderation reflects frequent market swings and global uncertainty, which made investors wary of deploying fresh lump sum capital. Concerns around geopolitical tensions, tariff-related disruptions, shifting interest rate expectations, and uneven corporate earnings contributed to bouts of volatility through the year.Mumukshu Desai, an financial advisor from Ahmedabad, said, “Monthly SIP and net inflow numbers remain intact and are growing at a routine pace of around 10–12%. Equity markets are still below their 2024 peak, with large-, mid- and even small-cap indices yet to fully recover, which is why AUM growth appears muted. SIP registrations, however, continue to rise month on month, reflecting investor conviction in the long-term equity story. Investors also became more shrewd, preferring phased allocations during corrections, with folio numbers growing in tandem. We expect 20% growth in inflows once markets recover decisively from current levels, similar to the sharp rise seen in gold and silver allocations 6 months ago. That said, new first-time investors and fresh KYC registrations slowed, indicating near-term caution.”Financial advisors expect equity AUM growth to remain measured in the near term, tracking market stability rather than momentum-driven inflows. Any sustained recovery in growth will depend on greater clarity on global cues, earnings visibility, and interest rate direction.“Some of the investors also diversified into gold instead of equity given the high returns the precious metals delivered in the recent past,” explained Jayesh Vithalani, an Ahmedabad-based financial advisor.