FlexSalary Instant Loan App Review : In today’s fast-paced world, financial emergencies don’t send a warning SMS. A medical bill, a car repair, or an unexpected school fee can arise at any moment, leaving you scrambling for solutions. In such times, traditional bank loans, with their lengthy paperwork and slow approval processes, are often not an option. This is where instant loan apps have revolutionized personal finance in India.

Leading this charge is the FlexSalary Instant Loan App, a platform designed to provide immediate, short-term financial relief directly from your smartphone. But is it the right choice for you? This ultimate, in-depth review will dissect every aspect of the FlexSalary app—from its features and interest rates to its eligibility criteria and application process. By the end of this guide, you will have all the information you need to make an informed decision.

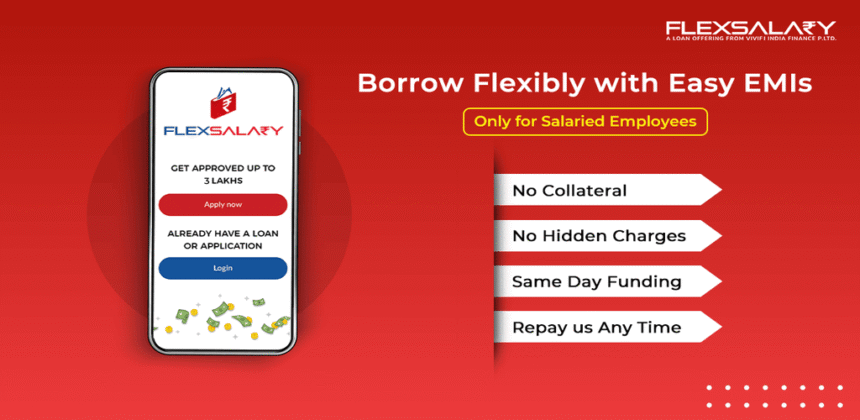

What is the FlexSalary Instant Loan App?

FlexSalary is a fintech company that offers a digital platform for availing instant personal loans. It is not a bank but a Non-Banking Financial Company (NBFC) registered with the Reserve Bank of India (RBI), which adds a layer of regulatory security for its users. The core premise of FlexSalary is to provide small-ticket, short-term loans that are disbursed directly to your bank account within minutes of approval.

The entire process—from application to disbursal—is paperless and happens through their mobile application. This eliminates the need for physical documentation, branch visits, and long waiting periods, making it a go-to solution for urgent cash needs.

Why Choose an Instant Loan App Like FlexSalary? The Key Benefits

The traditional lending system in India, while robust, is often ill-equipped to handle immediate, small-scale financial needs. Here’s where FlexSalary shines:

-

Unmatched Speed and Convenience: This is the biggest advantage. You can apply for a loan 24/7, 365 days a year, from anywhere. The approval is often instant, and disbursal happens within hours, if not minutes.

-

100% Paperless Process: There are no physical documents to submit, photocopy, or fax. Everything is handled digitally within the app, from identity verification to bank account linking.

-

Minimal Eligibility Requirements: Compared to banks that require high credit scores and extensive income proof, apps like FlexSalary have simpler criteria, often focusing on your current income and employment stability.

-

Flexible Loan Amounts: You can borrow small amounts (as low as ₹5,000) for very short tenures, which is perfect for managing small emergencies without getting into a large, long-term debt.

-

Build Your Credit Score: Many of these apps report repayment data to credit bureaus like CIBIL. timely repayment of your FlexSalary loan can help you build a positive credit history, which is crucial for availing larger loans (like home or car loans) in the future.

Deep Dive into FlexSalary App Features

Image Prompt: A digital collage showing the key features of the FlexSalary app: an icon of a shield for security, a lightning bolt for speed, a rupee sign with upward arrows for increasing limits, and a graph for credit building.

To understand its value proposition, let’s break down the specific features that FlexSalary offers:

-

Instant Loan Disbursal: Upon approval, the loan amount is transferred directly to your registered bank account swiftly. This “instant” aspect is the core of their service.

-

Flexible Loan Amounts: First-time users can typically access amounts from ₹5,000 to ₹15,000. As you build a good repayment history, your credit limit can increase significantly, going up to ₹2 Lakhs for trusted customers.

-

Flexible Tenure Options: You are not locked into a long-term commitment. Loan tenures usually range from 90 days to 24 months, allowing you to choose a repayment schedule that fits your monthly budget.

-

No Collateral Required: These are unsecured personal loans. You do not need to pledge any asset, property, or gold to avail of a loan.

-

CIBIL Score Check: The app allows you to check your CIBIL score for free. This is a valuable tool for understanding your overall credit health.

-

Secure and Encrypted Platform: FlexSalary uses bank-level encryption and data security protocols to ensure that your personal and financial information is safe from unauthorized access.

Eligibility Criteria: Who Can Apply?

The eligibility criteria for the FlexSalary instant loan app are designed to be inclusive and straightforward. To apply, you generally need to be:

-

An Indian citizen residing in India.

-

Between 21 and 58 years of age (age limits may vary slightly).

-

A salaried employee with a minimum monthly income (typically ₹12,000 – ₹15,000, though this can vary by city).

-

Possess a stable job with a certain minimum work experience (e.g., at least 3 months with the current employer).

-

Have a bank account and a valid mobile number linked to your Aadhaar card.

Documents Required: It’s Simpler Than You Think

Image Prompt: A flatlay of a smartphone displaying the FlexSalary app’s document upload screen. Next to the phone, place a physical Aadhaar card, PAN card, and a bank debit card, symbolizing the few documents needed.

The document process is incredibly simple. You will need digital copies of:

-

PAN Card: For identity and income verification.

-

Aadhaar Card: For address and identity verification (linked with your mobile number).

-

Bank Account Statement: Usually, the app fetches this digitally after you provide your net banking details or through an account aggregator system.

-

Salary Slips (for salaried individuals): To verify your income and employment.

That’s it. No physical copies, no attestation, no lengthy forms.

How to Apply for a Loan on the FlexSalary App: A Step-by-Step Walkthrough

Image Prompt: A series of 4 smartphone screenshots arranged in a grid, showing the sequential steps of applying for a loan on the FlexSalary app: 1) Download & Register, 2) Enter Personal Details, 3) Upload Documents, 4) Loan Approval Screen.

Applying for a loan is a seamless process. Follow these steps:

-

Download the App: Go to the Google Play Store (it’s currently available for Android users), search for “FlexSalary Instant Loan App,” and download the official application.

-

Register Your Account: Open the app and register using your mobile number, which should be linked to your Aadhaar card. You will receive an OTP to verify your number.

-

Complete Your Profile: Fill in your basic personal, employment, and income details as prompted by the app. Ensure all information is accurate to avoid rejection.

-

Submit KYC Documents: Upload the clear, digital copies of your PAN, Aadhaar, and other required documents directly within the app.

-

Link Your Bank Account: For income verification and disbursal, you will need to link your primary bank account. This is usually done securely through a net banking login or by verifying your account number and IFSC code.

-

Get Approval and Select Offer: The app’s algorithm will evaluate your application instantly. If approved, you will see a loan offer detailing the sanctioned amount, interest rate, tenure, and the total amount payable.

-

eSign the Agreement: Review the terms and conditions carefully. If you agree, you will need to electronically sign the loan agreement. This is a legally binding step.

-

Receive Funds: Once the agreement is signed, the loan amount will be disbursed directly to your linked bank account. You will receive an SMS and notification confirming the transaction.

Understanding the Cost: FlexSalary Interest Rates and Other Charges

This is the most critical section. While instant loans are convenient, they come at a cost. It is vital to understand all associated charges before you accept a loan offer.

-

Interest Rate: FlexSalary offers loans at a Monthly Reducing Interest Rate typically starting from 2.5% per month (which translates to an annualized percentage rate (APR) that is higher). It is crucial to note that the interest rate is calculated on a monthly reducing balance, which is a fairer method than a flat interest rate. Always check the exact rate offered to you in the app, as it can vary based on your risk profile and creditworthiness.

-

Processing Fee: A one-time processing fee is charged for facilitating the loan. This is usually a percentage of the loan amount or a fixed fee, whichever is higher. This fee is deducted from the loan amount before disbursal.

-

GST: Goods and Services Tax (GST) is applicable on the processing fee and the interest charged.

-

Late Payment Charges: If you fail to pay your EMI on the due date, a late payment fee will be levied. This can be a significant amount and can also negatively impact your credit score.

-

No Prepayment Penalty: A positive feature is that FlexSalary usually does not charge any penalty for foreclosing or prepaying your loan early. This can help you save on interest if you have surplus funds.

Pro Tip: Always use the loan calculator within the app to see the exact breakup of your Equated Monthly Installment (EMI) and the total cost of the loan before you accept the offer.

FlexSalary vs. Other Instant Loan Apps: A Quick Comparison

How does FlexSalary stack up against competitors like MoneyTap, EarlySalary, or KreditBee?

| Feature | FlexSalary | Other Popular Apps |

|---|---|---|

| Loan Amount | Up to ₹2 Lakhs | Up to ₹5 Lakhs (varies) |

| Interest Rate (p.m.) | Starting at ~2.5% | Starting at ~1.5% – 3% |

| Eligibility | Salaried Individuals | Salaried & Self-Employed (varies) |

| CIBIL Impact | Reports to bureaus | Most report to bureaus |

| Key Strength | Simple UI, Quick Disbursal | Larger amounts, Wider eligibility |

The best app for you depends entirely on your specific needs, the offer you receive, and your credit profile.

Is FlexSalary Safe and Legitimate?

Image Prompt: A close-up shot of a smartphone displaying the FlexSalary app’s security or privacy policy screen within the app. Overlay a transparent padlock icon on the screen to symbolize security.

A very valid concern, given the plethora of loan apps in the market. Yes, FlexSalary is a legitimate and safe platform.

-

RBI Compliance: It is operated by Hero FinCorp, which is an RBI-registered NBFC. This means it operates under the strict guidelines of the Reserve Bank of India.

-

Data Security: The company uses advanced encryption technology to protect user data. They have a clearly stated privacy policy that outlines how your data is collected and used.

-

Transparency: All fees, interest rates, and terms are disclosed upfront before you sign the agreement. There are no hidden charges if you read the offer carefully.

However, as with any financial product, the responsibility also lies with the user. Never share your OTP, ATM PIN, or app password with anyone. FlexSalary representatives will never ask for these details.

The Pros and Cons of Using FlexSalary

Pros:

-

Extremely quick and hassle-free application process.

-

No physical paperwork or branch visits.

-

Loans are disbursed within minutes/hours of approval.

-

Helps build a credit score if repaid on time.

-

No prepayment penalty.

-

Transparent about charges.

Cons:

-

Higher interest rates compared to traditional bank loans or credit cards.

-

Can lead to a debt trap if not used responsibly for genuine emergencies.

-

Late payments incur heavy fees and damage your credit score.

-

Currently only available for Android users (as of the time of writing).

Building Your Credit Score with FlexSalary

One of the most underrated benefits of using apps like FlexSalary is the opportunity to build a strong credit history. If you are new to credit or have a low score, getting a large loan from a bank is impossible.

By taking a small loan from FlexSalary and repaying it diligently on time, you demonstrate financial responsibility to the credit bureaus. This positive repayment history is recorded and helps build your score over time, making you eligible for larger, cheaper credit products in the future. The American credit system heavily emphasizes a history of diverse credit and on-time payments, and India is rapidly moving in the same direction. Using a tool like FlexSalary responsibly can be a strategic step in your financial journey.

Customer Support and Reviews

FlexSalary offers customer support through multiple channels, including in-app chat, email, and a phone helpline. User reviews on the Play Store are generally mixed, as is common with financial service apps. Many users praise the speed and convenience, while some complaints revolve around high-interest rates and customer service responsiveness. It’s always advisable to read recent reviews to get a sense of the current user experience.

Final Verdict: Should You Use the FlexSalary Instant Loan App?

The FlexSalary Instant Loan App is an excellent financial tool for salaried individuals facing a genuine, short-term cash crunch. It delivers perfectly on its promise of speed, convenience, and a paperless experience.

Use FlexSalary if:

-

You have a sudden emergency and need cash immediately.

-

You have a stable income and are confident of repaying the loan on time.

-

You want to avoid the hassle of traditional bank loans.

-

You want to start building or repairing your credit score.

Avoid it if:

-

You need a large amount of money for a long period (explore personal loans from banks or NBFCs instead).

-

You are not sure about your ability to repay the EMI on time.

-

You are looking for the cheapest possible borrowing option (a credit card or a loan from a bank will be cheaper).

In conclusion, the FlexSalary app is a legitimate, useful, and powerful tool in your financial arsenal. However, with great power comes great responsibility. Use it wisely, borrow only what you need, and repay on time to avoid falling into a debt cycle. It’s a bridge for your short-term financial gap, not a long-term financial strategy.