Demand for consumer credit rose 9.4 percent last month.

Photo: RNZ

Demand for consumer credit rose 9.4 percent last month, reflecting an increase in the number of mortgage applications and an elevated number of personal loans.

Credit research firm Centrix’s January Credit Indicator showed the increased demand for credit was somewhat offset by mixed number of credit arrears, and rising business liquidations.

“Arrears on the consumer side continue to follow the seasonal patterns. But that’s 0.8 percent down on last year. So that’s a really good sign that the tides are starting to turn, which is fantastic,” Centrix chief operating officer Monika Lacey said.

New household lending also rose in the December quarter, with lending for new mortgages up 14 percent, while non-mortgage lending rose 12 percent.

Arrears

Mortgage arrears were steady, though vehicle loans were under pressure.

The South Island had the lowest number of arrears, while the central North Island and East Cape had the highest level of arrears.

Company failures highest since 2010

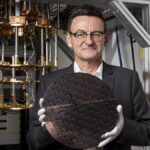

Centrix chief operating officer Monika Lacey.

Photo: Supplied

“On the business side, they’ve also seen an increase in demand, but liquidations have definitely hit their highest peak since 2010 largely impacted by hospitality, retail, transport and construction, and this is largely as a result of IRD (Inland Revenue) increasing their activity following a softer approach over the Covid time,” Lacey said.

The number of company failures rose to its highest annual level since 2010, with liquidations unevenly seen across sectors, with rises in hospitality (+50 percent), retail trade (+34 percent) and transport (+27 percent) accounting for most of the failures.

There were also increases in construction (+13 percent), manufacturing (+12 percent) and property/rental (+17 percent) recording liquidations, even as credit defaults declined and average credit scores improved in many areas.

In contrast, agriculture stood out as the most resilient sector, with liquidations down 11 percent year-on-year, supported by stronger credit demand and improving financial health.

“Agri has definitely had a bit of a turnaround. There’s been a lot of positive news in the agricultural sector. So long may that continue,” she said.

“We’re hearing a little bit more about other good economic signals filtering through onto the market, so I think we are starting to see some signs of recovery.”

Credit demand

Overall business credit demand edged slightly higher, rising 0.7 percent year-on-year over the period.

Growth was highly concentrated in a few sectors, led by a 38 percent increase in hospitality credit demand, reflecting improving trading conditions and funding needs.

Education and training (+17 percent) and retail trade (+13 percent) also recorded solid gains, while demand elsewhere remained subdued.

“I think the increase in mortgage activity is largely attributed to refinancing,” she said.

“And personal loans, we would tend to see an uptick at this time of year anyway, but I think it’s certainly a sign that consumers are feeling a little bit more confident and perhaps have a little bit more cash in their pockets.”

Sign up for Ngā Pitopito Kōrero, a daily newsletter curated by our editors and delivered straight to your inbox every weekday.