Best U.S. Loan : For millions of American entrepreneurs, access to capital represents the single greatest barrier between vision and reality. The journey from startup to success story often requires financial fuel—for equipment purchases, real estate acquisitions, workforce expansion, or simply maintaining cash flow during growth phases. This is where SBA loans enter the picture as one of the most powerful tools in the small business financing arsenal. The U.S. Small Business Administration doesn’t directly lend money but instead provides government-backed guarantees that make traditional lenders more willing to extend credit to small businesses that might not otherwise qualify.

The statistics tell a compelling story: in FY2024 alone, 70,242 SBA 7(a) loans were approved, worth a combined $31.1 billion. These numbers reflect more than just financial transactions—they represent dreams realized, jobs created, and communities strengthened. Whether you’re launching your first venture, expanding an existing operation, or navigating recovery from unexpected challenges, understanding SBA loan programs could be the difference between stagnation and growth.

This comprehensive guide will demystify the SBA loan landscape, providing you with actionable insights into eligibility requirements, application processes, and strategic considerations to maximize your chances of approval. By the end, you’ll possess a clear roadmap to securing the financing that could transform your business trajectory.

Understanding the SBA’s Mission and How It Benefits You

The SBA’s Role in Small Business Financing

The Small Business Administration was established in 1953 as part of the Small Business Act with a clear mission: to aid, counsel, assist, and protect the interests of small business concerns. Rather than functioning as a direct lender (except in disaster situations), the SBA primarily operates as a guarantor, setting guidelines for loans and reducing lender risk. This crucial distinction means that while the SBA establishes parameters and provides backing, you’ll work directly with approved lenders—banks, credit unions, or specialized lending institutions—throughout the application and funding process.

This public-private partnership model benefits all parties involved. For lenders, the government guarantee (typically ranging from 50% to 90% depending on the program) mitigates risk, making them more willing to extend credit to businesses that might appear marginal by conventional underwriting standards. For borrowers, this translates to increased access to capital, often with more favorable terms than would otherwise be available. The system essentially creates a win-win scenario where private capital flows to small businesses while protected by a public guarantee.

Why SBA Loans Stand Out in the Financing Landscape

SBA-guaranteed loans offer distinct advantages over conventional business loans:

-

Competitive Terms: Interest rates and fees on SBA loans are generally comparable to non-guaranteed loans, despite the additional layer of government oversight.

-

Extended Repayment Periods: Unlike many conventional loans that demand quick repayment, SBA loans offer terms up to 25 years for real estate purchases and 10 years for other purposes, dramatically reducing monthly payments and improving cash flow.

-

Lower Down Payments: SBA programs often require smaller down payments than conventional commercial loans—sometimes as low as 10% compared to 20-30% typically required by banks.

-

Counseling and Education: Many SBA loans come with access to business counseling and educational resources, providing valuable support beyond just funding.

-

Flexibility: SBA loans can be used for a wide variety of business purposes, from working capital and equipment purchases to real estate acquisition and debt refinancing.

Deep Dive: SBA’s Flagship 7(a) Loan Program

What Exactly Is a 7(a) Loan?

The 7(a) loan program is the SBA’s primary and most versatile business loan program, named for section 7(a) of the Small Business Act that created it. This program provides financial assistance to small businesses with special requirements, offering loan guarantees to lenders that enable them to extend credit they might otherwise decline.

The scope of 7(a) loans is remarkably broad. Businesses can use these funds for:

-

Acquiring, refinancing, or improving real estate and buildings

-

Short- and long-term working capital needs

-

Refinancing existing business debt

-

Purchasing and installing machinery and equipment (including AI-related expenses)

-

Acquiring furniture, fixtures, and supplies

-

Financing changes of ownership (complete or partial)

-

Multiple-purpose loans combining several of the above uses

The maximum loan amount for a 7(a) loan is $5 million, making it suitable for a wide range of business needs from modest expansions to significant acquisitions.

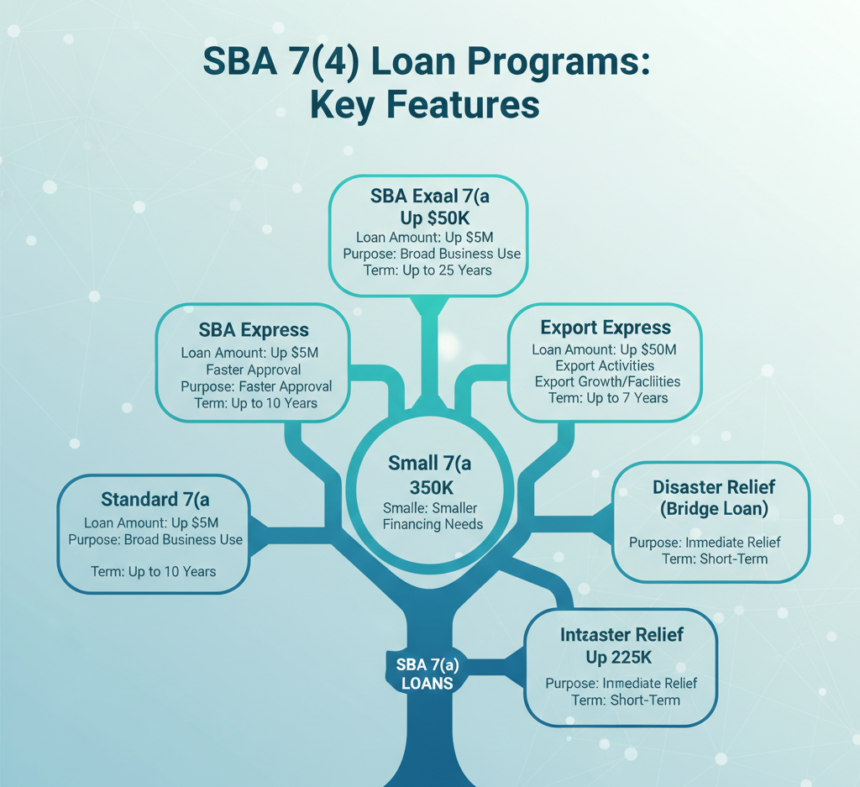

Understanding the Various 7(a) Loan Types

While all 7(a) loans share common characteristics, several specialized versions cater to specific business situations:

Standard 7(a) Loans: These encompass loans greater than $350,000 (excluding specific specialized programs). They may be processed under Preferred Lender Program delegated authority or through the SBA’s Loan Guaranty Processing Center.

7(a) Small Loans: Designed for more modest financing needs up to $350,000, these loans feature streamlined processing with SBA turnaround times of 2-10 business days. They offer higher guarantee percentages (85% for loans up to $150,000 and 75% for loans between $150,001 and $350,000).

SBA Express Loans: This program allows certain lenders to use their own processes and procedures in exchange for a lower SBA guarantee (50%). The maximum loan amount is $500,000, and these loans can be approved in as little as 36 hours, making them ideal for businesses needing quicker access to capital.

Export-Related 7(a) Loans: Recognizing that most U.S. banks view export financing as particularly risky, the SBA offers specialized programs including Export Express and Export Working Capital Program loans with guarantees up to 90% to support businesses developing international markets.

CAPLines: This umbrella program addresses short-term and cyclical working capital needs through several subtypes: Seasonal CAPLines (for businesses with predictable seasonal fluctuations), Contract CAPLines (for contract-based businesses), Builders CAPLines (for small contractors), and Working CAPLines (asset-based revolving credit).

7(a) Working Capital Pilot (WCP) Program: A newer pilot program offering monitored lines of credit up to $5 million, specifically designed for growing small businesses in industries like manufacturing, wholesale, or professional services. The WCP program includes one-on-one counseling with SBA subject-matter experts.

Key 7(a) Loan Terms and Financial Considerations

Understanding the financial specifics of 7(a) loans is crucial for effective planning:

-

Interest Rates: 7(a) loan interest rates are based on the Wall Street Journal Prime Rate, with spreads that vary by loan size and type. For 2026, rates for real estate loans (25-year terms) typically range from WSJ Prime plus 2.75% for special use property to 8.75% for mixed-use property. Non-real estate loans (10-year terms) generally carry rates of WSJ Prime plus 3.50% for loans under $350,000 and WSJ Prime plus 2.75% for loans between $350,001 and $5 million.

-

Loan Terms: Maximum terms are 25 years for real estate and 10 years for other purposes. Working capital loans typically have 5-7 year terms.

-

Guarantee Percentages: The SBA guarantee varies by loan type and size—from 50% for Express loans to 90% for certain export and working capital programs. For standard 7(a) loans over $350,000, the guarantee is typically 75%.

-

Down Payment Requirements: While loans of $500,000 or less often require no down payment, loans over $500,000 that include a change of ownership generally require a 10% down payment.

-

Collateral Requirements: SBA considers a loan “fully secured” if the lender has taken security interests in all assets being acquired, refinanced, or improved with the loan proceeds. For loans under $50,000, the SBA generally doesn’t require collateral, and loans between $50,001 and $500,000 follow the lender’s existing collateral policies.

-

Personal Guarantees: All owners with 20% or more stake in the business must provide personal guarantees.

-

Prepayment Penalties: These decrease over a three-year period—5% in year one, 3% in year two, 1% in year three, with no penalty thereafter.

Eligibility Requirements for 7(a) Loans

To qualify for 7(a) loan assistance, businesses must meet several criteria:

-

Be an operating, for-profit business officially registered and operating legally

-

Be physically located and operate in the United States or its territories

-

Meet SBA size standards for their specific industry

-

Demonstrate creditworthiness and a reasonable ability to repay the loan

-

Not be engaged in ineligible activities (lending, rental real estate, investing, or speculation)

-

Not be able to obtain the desired credit on reasonable terms from non-government sources

All owners must be U.S. citizens, legal foreign nationals, or permanent residents. Owners of 20% or more must not be currently incarcerated or under indictment and must not have a previous failed government-backed loan.

The SBA 504 Loan Program: Financing Major Fixed Assets

Understanding 504 Loans and How They Differ from 7(a)

While the 7(a) program offers remarkable versatility, the SBA 504 loan program serves a more specialized purpose: providing long-term, fixed-rate financing for major fixed assets that promote business growth and job creation. Administered through Certified Development Companies (CDCs)—SBA’s community-based nonprofit partners—504 loans offer distinct advantages for specific business scenarios.

The fundamental structural difference lies in how 504 loans are financed. Typically, a 504 loan involves three parties: a private-sector lender (providing 50% of the financing), a CDC (providing up to 40% through an SBA-guaranteed debenture), and the borrower (contributing as little as 10% equity). This structure creates unique benefits, particularly for businesses making substantial capital investments.

Appropriate Uses for 504 Loans

The 504 program is specifically designed for acquiring, constructing, or improving significant fixed assets:

-

Purchasing existing buildings, land, or new facilities

-

Acquiring long-term machinery and equipment with a useful remaining life of at least 10 years (including project-related AI-supported equipment)

-

Improving or modernizing land, streets, utilities, parking lots, landscaping, or existing facilities

-

In specific circumstances, consolidating or refinancing qualified debt

Notably, 504 loans cannot be used for working capital or inventory, speculation or investment in rental real estate, or financing AI-related soft costs like consulting services or intellectual property. This specialization makes the 504 program particularly valuable for manufacturers, wholesalers, and other businesses with substantial physical asset requirements.

504 Loan Terms and Financial Considerations

The 504 program offers several compelling financial advantages:

-

Maximum Loan Amount: Up to $5.5 million (or up to $6.5 million for certain energy-efficient or manufacturing projects)

-

Fixed Interest Rates: Pegged to an increment above the current market rate for 10-year U.S. Treasury issues, providing protection against rate fluctuations

-

Long Repayment Terms: 10, 20, and 25-year maturity terms are available, significantly reducing monthly payments

-

Lower Down Payments: Often as low as 10%, compared to the 20-30% typically required for conventional commercial real estate loans

-

Fee Structure: Total fees typically approximate 3% of the debt and may be financed with the loan

Eligibility Requirements for 504 Loans

To qualify for a 504 loan, businesses must:

-

Operate as a for-profit company in the United States or its possessions

-

Have a tangible net worth of less than $20 million

-

Have an average net income of less than $6.5 million after federal income taxes for the two years preceding application

-

Fall within SBA size guidelines

-

Have qualified management expertise, a feasible business plan, good character, and the ability to repay the loan

Businesses engaged in nonprofit, passive, or speculative activities are ineligible.

Microloans: Small Amounts, Significant Impact

The Microloan Program Explained

For businesses needing smaller amounts of capital, the SBA Microloan program provides loans up to $50,000, with the average microloan being approximately $13,000. Unlike other SBA programs, microloans are delivered through specially designated intermediary lenders—nonprofit community-based organizations with experience in lending as well as management and technical assistance.

This structure creates unique advantages for certain borrowers. Intermediary lenders often serve niche communities or specialize in particular types of businesses, bringing both financial support and valuable mentorship to the relationship. The program particularly benefits startups, very small businesses, and certain not-for-profit childcare centers that might struggle to secure traditional financing.

How Microloans Can Be Used

Microloan proceeds offer flexibility for various business needs:

-

Working capital

-

Inventory purchases

-

Supplies, furniture, and fixtures

-

Machinery and equipment

Notably, microloan funds cannot be used to pay existing debts or purchase real estate, distinguishing them from other SBA loan programs. This restriction ensures the program serves its intended purpose of providing growth capital rather than debt consolidation.

Microloan Terms and Considerations

Understanding the financial specifics of microloans is crucial:

-

Maximum Loan Amount: $50,000 (average loan approximately $13,000)

-

Interest Rates: Vary by intermediary lender but generally fall between 8% and 13%

-

Repayment Terms: Maximum term of seven years, with specific terms varying based on loan amount, planned use, lender requirements, and borrower needs

-

Collateral and Guarantees: Each intermediary lender sets its own requirements, but generally requires some type of collateral as well as the personal guarantee of the business owner

Specialized SBA Loan Programs for Unique Needs

Beyond the flagship programs, the SBA offers several specialized financing options for specific business situations.

Disaster Loans: Recovery After Catastrophe

Unlike other SBA programs, disaster loans are provided directly by the SBA (not just guaranteed) to help businesses, homeowners, and renters recover from declared disasters. These critical resources come in several forms:

-

Business Physical Disaster Loans: Up to $2 million to repair or replace damaged real estate, equipment, inventory, and other business assets

-

Economic Injury Disaster Loans (EIDL): Up to $2 million in working capital to help small businesses meet ordinary financial obligations that cannot be met due to disaster impacts

-

Home and Personal Property Disaster Loans: Up to $200,000 for primary home repair/replacement and up to $40,000 for personal property losses

Export Assistance Programs

Recognizing that most U.S. banks consider export financing particularly risky, the SBA offers specialized programs to help small businesses compete internationally:

-

Export Working Capital Program: Provides short-term, transaction-specific financing for businesses with export sales

-

International Trade Loans: Long-term financing to help businesses compete more effectively against imports or expand into export markets

-

Export Express: Streamlined financing up to $500,000 for businesses developing or expanding export activities

Rural and Community Development Initiatives

The SBA also offers specialized programs targeting underserved communities:

-

Rural Initiative Pilot Program: Waives certain regulations to expand capital access in qualified rural areas

-

Community Advantage Pilot Program: Focuses on mission-based lenders serving underserved markets

The Step-by-Step SBA Loan Application Process

Phase 1: Preparation and Initial Research (Days 1-14)

Step 1: Self-Assessment and Documentation Gathering

Before approaching lenders, conduct an honest assessment of your business’s financial health and needs. Begin gathering essential documents, including:

-

Three years of business and personal tax returns

-

Year-to-date profit and loss statements and balance sheets

-

Business debt schedule

-

Personal financial statements for all owners with 20%+ stake

-

Business legal documents (articles of incorporation, licenses, leases)

-

Business plan (especially for startups or significant expansions)

Step 2: Program Selection

Based on your specific needs (amount, purpose, timeline), determine which SBA program best aligns with your situation. Consider:

-

Loan amount needed (under $50,000, $50K-$350K, $350K-$5M, over $5M)

-

Primary purpose (working capital, equipment, real estate, export)

-

Desired repayment terms

-

Urgency of need

Phase 2: Lender Engagement and Pre-Qualification (Days 15-45)

Step 3: Lender Selection and Initial Consultation

Use the SBA’s Lender Match tool to connect with appropriate lenders. Consider both traditional banks and specialized SBA lenders. Prepare for initial consultations by having your executive summary and basic financials ready.

Step 4: Formal Application Submission

Complete the lender’s application package, which will typically include SBA Form 1919 and various lender-specific forms. Be thorough and accurate—inconsistencies can delay the process.

Step 5: Preliminary Underwriting

The lender will conduct initial due diligence, reviewing your credit history, business financials, and proposed use of funds. This stage may involve requests for additional documentation or clarification.

Phase 3: Full Underwriting and SBA Review (Days 46-75)

Step 6: Comprehensive Underwriting

For loans requiring SBA approval (non-delegated authority loans), the lender prepares a complete package for SBA review. This includes detailed analysis of your business’s ability to repay, management expertise, and collateral adequacy.

Step 7: SBA Processing and Approval

The SBA reviews the package, typically within 5-10 business days for standard loans (though Express loans can be approved in 36 hours). During peak periods, processing may take longer.

Phase 4: Closing and Funding (Days 76-90+)

Step 8: Commitment Letter and Closing Conditions

Upon approval, you’ll receive a commitment letter outlining loan terms and any conditions that must be satisfied before closing (appraisals, environmental assessments, insurance certificates, etc.).

Step 9: Closing Document Preparation

Your lender prepares closing documents, which you should review carefully with your attorney or financial advisor.

Step 10: Funding

After signing closing documents and satisfying all conditions, funds are disbursed—often directly to vendors for equipment or real estate purchases, or to your business account for working capital.

Critical Success Factors: Maximizing Your Approval Chances

Strengthen Your Credit Profile

Creditworthiness is a fundamental consideration for SBA lenders. While specific requirements vary, most lenders prefer:

-

Personal credit scores of 680+ (though some programs may accept scores as low as 640)

-

Business credit history demonstrating responsible repayment

-

Limited recent credit inquiries

-

No recent bankruptcies, foreclosures, or tax liens

If your credit needs improvement, consider taking 6-12 months to address issues before applying: pay down existing debt, correct credit report errors, and establish consistent payment patterns.

Prepare a Compelling Business Plan

For startups or businesses seeking expansion capital, a comprehensive business plan is essential. Your plan should include:

-

Executive summary

-

Company description

-

Market analysis

-

Organization and management structure

-

Product or service line

-

Marketing and sales strategy

-

Funding request with detailed use of proceeds

-

Financial projections (3-5 years)

-

Appendix with supporting documents

Demonstrate “Skin in the Game”

Lenders want to see that you’re personally invested in your business’s success. This includes:

-

Personal investment in the business (typically 10-30% of project cost)

-

Personal guarantees from all owners with 20%+ stake

-

Willingness to pledge available collateral

Prove Ability to Repay

Lenders need confidence that your business can service the debt. Prepare to demonstrate:

-

Historical profitability or credible path to profitability

-

Strong cash flow relative to proposed debt payments

-

Industry experience and management capability

-

Market demand for your products/services

Common Application Mistakes and How to Avoid Them

Incomplete or Inaccurate Documentation

The most frequent cause of delays is incomplete application packages. Avoid this by:

-

Using the lender’s checklist meticulously

-

Providing explanations for any anomalies in financials

-

Ensuring consistency across all documents (dates, amounts, names)

-

Including all required signatures

Underestimating the Time Required

Many applicants mistakenly believe SBA loans can be secured quickly. In reality, the process typically takes 60-90 days (or longer for complex transactions). Begin early, especially if you have time-sensitive needs like a real estate purchase contract.

Lack of Preparation for the “Credit Elsewhere” Test

SBA loans require that you cannot obtain financing on reasonable terms from non-government sources. Be prepared to demonstrate that you’ve explored conventional options, perhaps by providing denial letters or evidence of unattractive terms from traditional lenders.

Insufficient Equity Injection Planning

Many applicants underestimate the amount of personal funds required. Remember that SBA loans rarely cover 100% of project costs—you’ll typically need 10-30% equity, depending on the program and circumstances.

Beyond Approval: Managing Your SBA Loan Successfully

Understanding Your Responsibilities as a Borrower

Once funded, you have ongoing obligations:

-

Making timely payments (consider setting up automatic payments)

-

Maintaining adequate insurance on collateral

-

Notifying your lender of significant business changes

-

Allowing periodic inspections of collateral

-

Providing annual financial statements (if required)

Utilizing SBA Resources Beyond Financing

The SBA offers valuable support services that many borrowers overlook:

-

SCORE Mentoring: Free business mentoring from experienced executives

-

Small Business Development Centers (SBDCs): Low-cost training and counseling

-

Women’s Business Centers: Specialized support for women entrepreneurs

-

Veterans Business Outreach Centers: Services for veteran-owned businesses

-

SBA Learning Center: Free online courses on various business topics

Planning for the Future: Refinancing and Additional Borrowing

As your business grows, you may need additional financing or want to refinance existing debt. Understand that:

-

SBA loans can often be refinanced under certain conditions

-

You can typically apply for additional SBA financing after demonstrating successful use of previous funds

-

Building a strong relationship with your lender can facilitate future borrowing needs

The Evolving Landscape: SBA Loans in 2026 and Beyond

Technological Innovations in SBA Lending

The SBA loan process is becoming increasingly digitized. Recent developments include:

-

Enhanced online application portals

-

Electronic document submission and verification

-

AI-powered underwriting tools for certain Express loans

-

Digital platforms connecting borrowers with multiple lenders simultaneously

Policy Changes and Their Implications

Stay informed about evolving SBA policies that might affect your borrowing options:

-

Fee Structures: SBA guarantee fees are subject to annual review and adjustment

-

Program Expansions: Pilot programs like the 7(a) Working Capital Program may expand or become permanent

-

Eligibility Adjustments: Size standards and eligibility criteria are periodically updated

Economic Factors Influencing SBA Lending

Several macroeconomic factors impact SBA loan availability and terms:

-

Interest Rate Environment: As SBA rates are tied to the prime rate, Federal Reserve policies directly affect borrowing costs

-

Economic Cycles: Lender risk appetite and SBA priorities shift during expansions versus contractions

-

Industry-Specific Trends: Certain sectors may receive special attention based on national priorities

Alternative Financing Options: When SBA Loans Aren’t the Right Fit

While SBA loans offer exceptional value for many businesses, they’re not ideal for every situation. Consider alternatives when:

You Need Funds Quickly

If you require capital in under 30 days, explore:

-

Business lines of credit

-

Invoice factoring or financing

-

Merchant cash advances

-

Online term loans

Your Business Doesn’t Meet SBA Requirements

If you’re in an ineligible industry (like real estate investment) or don’t meet size standards, consider:

-

Conventional bank loans

-

Equipment financing

-

Commercial real estate loans

-

Revenue-based financing

You Need a Smaller Amount

For needs under $50,000 (especially under $25,000), alternatives might include:

-

Credit cards (for short-term needs)

-

Personal loans

-

Crowdfunding

-

Grants (for specific business types)

Conclusion:

Navigating the world of SBA loans can seem daunting, but the potential rewards make the journey worthwhile. These government-backed programs have fueled countless American success stories, providing the capital necessary to transform entrepreneurial visions into thriving enterprises. By understanding the nuances of different SBA programs, meticulously preparing your application, and partnering with the right lender, you position your business to access some of the most favorable financing available in the market.

Remember that the SBA loan process is as much about relationship-building as it is about paperwork. The lenders, CDCs, microloan intermediaries, and SBA resource partners you engage with can become valuable long-term allies in your business growth. Their expertise extends beyond mere transaction processing—they often provide insights, connections, and guidance that prove invaluable over time.

As you embark on your financing journey, maintain both patience and persistence. The process requires significant effort, but the result—affordable capital to grow your business on your terms—represents one of the most powerful tools available to American entrepreneurs. Whether you’re seeking $10,000 through a microloan or $5 million through a 504 program, the SBA’s suite of financing options stands ready to help bridge the gap between where your business is today and where you envision it tomorrow.

Disclaimer: This guide provides general information about SBA loan programs. Program details, interest rates, fees, and requirements are subject to change. Always consult with qualified financial professionals and SBA-approved lenders for the most current information and personalized advice for your specific situation.