Earlier this month, Amazon unveiled its financial results for 2025, revealing a story that goes deeper than just sales growth.

For the first time, Amazon overtook Walmart as the world’s largest company by sales revenue.

Amazon’s group net sales, which climbed 12% to $716bn (€601.5bn) in 2025, up from $638bn in 2024, was particularly remarkable as the organisation had to contend with the Trump administration tariffs war with China, where it sourced much of supplies, and the end of the ‘de minimus’ duty free exemption forcing customs inspection and duty charges on their core small packages business.

The regulatory changes significantly impacted cross-border sales in 2025, leading to higher prices, reduced margins for sellers and impacting established inventory strategies.

Under these trading pressures it is remarkable that Amazon maintained its double-digit sales growth, cementing its ranking as the global leader in e-commerce.

But what truly fuelled the revenue surge was its services division — Amazon Web Services (AWS) — accounting for nearly 60% of overall group sales.

AWS showed an impressive 20% sales growth in the year and provided the bulk of group operating profits.

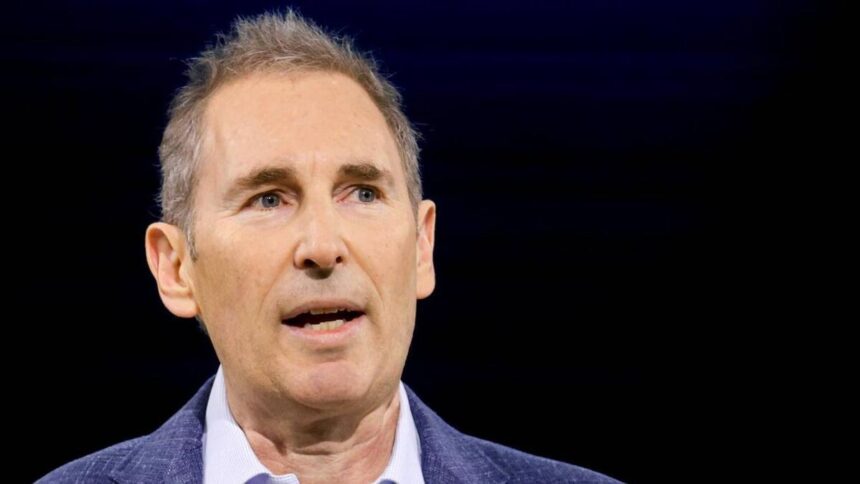

In the fourth quarter and annual financial announcement session, it became clear AI is set to become central to AWS’s cloud offerings. Amazon CEO Andy Jassy stated:

“With robust demand for our current products and exciting prospects in AI, chips, robotics, and low earth orbit satellites, we plan to invest about $200 billion in capital expenditures across Amazon in 2026, aiming for strong long-term returns.”

Despite Andy Jassy’s assertions, analysts came to the conclusion that most of the $200bn capital investment was being directed toward AI infrastructure.

Global investors were sceptical of the strategy and as a consequence Amazon shares were hit by the largest drop since 2022.

Analysts cited worries about the risks tied to AI spending and doubts regarding its profitability.

Amazon explained that the massive investment wouldn’t be focused solely on AI infrastructure; it would also support the expansion of AWS data centres and development of custom chips, though AI will continue to attract interest in AWS’s cloud services.

Additionally, the company reaffirmed its dedication to physical retail — even after closing Amazon Go and Amazon Fresh stores — and outlined plans for new hybrid retail-distribution sites.

Analysts increasingly argue, however, that online product sales remain unprofitable, with profits from its AWS division funding the aggressive pricing, speedy shipping, and market leadership.

In Ireland, the e-commerce product division employing 4,818 may be at risk following Mr Jassy’s January announcement of a significant new round of labour cutbacks, aiming to cut approximately 16,000 corporate jobs worldwide as he pushes to improve profitability in this sector.

However, at AWS Ireland division — ADSIL — which employs 1,682, the company recently announced it is actively recruiting up to 1,000 added personnel, particularly within its data centre teams in Ireland, despite global corporate restructuring and the reported layoffs.

In December an Bord Pleanála granted AWS planning permission to build three additional data centres at its Dublin campus, making it the largest data centre operator in Ireland.

Grid capacity may limit future projects, but Amazon has managed supply lines effectively in the past.

With AWS remaining at the heart of Amazon’s strategy and future investments, further growth is expected at operations in Cork and Dublin, where revenues jumped 16.5% to over €7bn in 2024, and net profits rose by 23%.

Analysts looking at the 2025 figures, predict Amazon Corporation is on track for substantial expansion through to 2030, estimating its market capitalisation could reach $3trillion (tn) to $5tn.

The company’s growing dominance in high-margin areas like cloud computing (AWS), digital advertising, and advancements in AI point to a strategic evolution, from a retail-based enterprise to a broad technology powerhouse, support the analyst’s predictions.