In today’s fast-paced economy, the bi-weekly or monthly pay cycle is a relic that fails to align with modern financial realities. A staggering 78% of American workers live paycheck to paycheck, according to a 2023 report. An unexpected car repair, a medical co-pay, or a simple gap between bills can create a financial crisis, forcing many to turn to high-interest payday loans, credit card cash advances, or overdraft fees that can trap them in a cycle of debt.

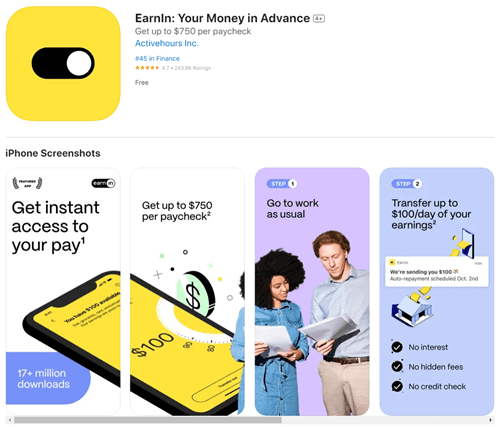

Enter EarnIn—a financial technology app that has revolutionized the concept of wage access. By allowing you to access money you’ve already earned before your official payday, EarnIn aims to provide a lifeline without the predatory fees. But is it truly the solution it promises to be? How does it stack up against competitors like PayActiv, Dave, or Even? This comprehensive, 8800+ word guide will dissect every facet of the EarnIn platform, from its core functionality and cost structure to its potential pitfalls and ideal user profile. We will explore its impact on financial wellness, compare it with key alternatives, and provide you with the knowledge to decide if it’s the right tool for your financial toolkit.

Chapter 1: What is EarnIn? Demystifying the Earned Wage Access Model

EarnIn is not a loan. This is the most critical point to understand. It is an Earned Wage Access (EWA) platform. EWA is a category of financial technology that provides workers with access to a portion of their already-earned, but not yet paid, wages before their scheduled payday.

The Core Philosophy: Your financial needs don’t operate on a 14 or 30-day cycle. Why should your access to your own money? EarnIn’s model is built on the principle that you should have control over your earnings as you accrue them, not just when your employer’s payroll department processes them.

How It Fundamentally Differs from Payday Loans:

-

No Interest: Payday loans often carry APRs that can exceed 400%. EarnIn charges no interest.

-

Not a Debt Instrument: You are not taking on new debt. You are accessing wages you have already earned. This means no credit checks (for the basic service) and no impact on your credit score for using it.

-

Fee Structure: While payday loans have steep, mandatory fees and interest, EarnIn’s primary monetization is through optional “Tips” and expedited transfer fees.

A Brief History of EarnIn:

Founded in 2012 under the name “ActiveHours,” the company pioneered the EWA concept. It rebranded to EarnIn in 2018 to better reflect its mission. It has since grown to serve millions of users, partnering with major employers and raising significant capital from top-tier investors. Its growth underscores a massive, unmet need in the market for flexible, equitable financial services.

Chapter 2: How Does EarnIn Work? A Step-by-Step Walkthrough

Using EarnIn is designed to be intuitive. Here’s a detailed breakdown of the process from setup to cash-out.

Step 1: Download and Sign Up

Download the EarnIn app from the Google Play Store or Apple App Store. Registration requires your phone number, email, and a few personal details. Crucially, EarnIn performs a soft credit check during sign-up, which does not affect your credit score. This is primarily for identity verification.

Step 2: Connect Your Information

EarnIn needs to verify your income and work schedule. You do this through one of two primary methods:

-

Timesheet Upload: Manually upload photos of your digital or paper timesheets.

-

Electronic Connection: The most seamless method. Connect the app to your work email account (to read pay stub emails) or, if your employer has a direct partnership with EarnIn, to your company’s payroll system. You can also allow location services to confirm you are at your workplace when clocked in.

Step 3: Determine Your Earned Balance

Once connected, the app tracks your hours worked in real-time (or via your uploaded timesheets). It calculates how much money you’ve earned based on your hourly wage or salary. This amount becomes your available balance to access.

Step 4: Access Your Cash

You can withdraw up to $100 per day and up to $750 per pay period (these limits can increase to $1,000 for long-term users in good standing). You have two transfer options:

-

Standard Speed (Free): The money is deposited into your connected bank account, typically by the next business day.

-

Lightning Speed (Fee): For an instant transfer to your debit card, EarnIn charges a small fee (e.g., $1.99 to $4.99). This is a key revenue source for the app.

Step 5: Repayment

On your actual payday, EarnIn automatically settles the “cash out” amount from your linked bank account. They initiate an ACH withdrawal for the total amount you accessed. You must ensure sufficient funds are in the account to avoid bank overdraft fees.

Chapter 3: Deep Dive into EarnIn’s Key Features and Tools

Beyond basic cash advance, EarnIn bundles several tools aimed at holistic financial health.

1. The EarnIn Cash Out (Core EWA): As described, this is the flagship feature.

2. Balance Shield (Overdraft Prevention): This is a critical and popular feature. You connect your checking account, and EarnIn monitors its balance. If it’s projected to fall below a threshold you set (e.g., $100), EarnIn can automatically transfer an amount (up to $100) to prevent an overdraft. This is repaid on your next payday, just like a standard cash out. It’s a powerful tool to avoid $35+ bank overdraft fees.

3. Tip Yourself (Savings Tool): This feature gamifies saving. You set rules (e.g., “save $5 every time I go to the gym” or “save $10 on every payday”) and the app rounds up transactions or follows your rules to move small amounts into a “Tip Yourself” savings pot within the app. It encourages micro-saving behavior, which can be more sustainable for those struggling to save.

4. Financial Calendar & Insights: The app provides a clear view of your paydays, cash-out history, and bill due dates in one calendar. This helps with budgeting and visualizing your cash flow cycle.

5. No-Fee Banking (EarnIn Express): EarnIn offers an optional Visa debit card and connected account. This can be used to receive your wages and accessed funds instantly, bypassing the “Lightning Speed” fee if you cash out to this card.

Chapter 4: The Cost of Using EarnIn: “Tips,” Fees, and the True Price

EarnIn markets itself as “No Fees. No Interest.” This is true in the strictest sense for its standard service. However, users should fully understand its monetization.

The “Tip” Model: After you cash out, EarnIn invites you to leave a voluntary tip for the service. Tips typically range from $0 to $14 per $100 withdrawn. The app suggests amounts ($1, $3, $9, etc.). This is optional. You can tip $0. The company states that tips help keep the service free for everyone and support their mission.

Criticism of the Tip Model:

-

Psychological Pressure: The interface can create a sense of obligation or guilt, potentially leading users to pay more than they can afford.

-

Lack of Transparency: What is a “fair” tip? The model obscures the true cost of the service, making it hard to compare to flat-fee alternatives.

-

Potential for High Effective Cost: If a user consistently tips $9 on a $100 advance for a 7-day period, the annualized percentage rate (APR) equivalent could be high, even though it’s not technically interest.

Mandatory Fees:

-

Lightning Speed Fee: For instant transfers to an external debit card. This is a clear, upfront fee.

-

Express Card Fees: While the EarnIn Express card itself has no monthly fees, certain actions like out-of-network ATM withdrawals may incur charges.

The Verdict on Cost: For a user who uses standard transfers and tips minimally or not at all, EarnIn can be virtually free. For users who frequently need instant cash and feel compelled to tip high, the cost can become significant. It requires disciplined, informed use to keep costs near zero.

Chapter 5: The Pros and Cons of EarnIn – A Balanced Analysis

Pros:

-

Breaks the Payday Loan Cycle: Provides a critical alternative to devastatingly expensive debt.

-

No Mandatory Interest or Credit Checks: Lowers the barrier to access and removes the fear of sinking into debt.

-

Overdraft Prevention (Balance Shield): A genuinely valuable feature that saves users from hefty bank fees.

-

Promotes Financial Awareness: The calendar and tracking tools help users understand their income and spending cycles.

-

Fast and User-Friendly: The app is highly rated for its intuitive design and quick access to funds.

Cons:

-

The Tip Model Can Be Misleading: It can pressure users into unsustainable costs and lacks pricing clarity.

-

Potential for Dependency: Easy access can discourage long-term budgeting and savings habits, becoming a crutch rather than a solution.

-

Repayment Risk: If you don’t have the full amount in your account on payday, the ACH withdrawal could fail, leading to potential bank fees and possible suspension from EarnIn’s services.

-

Limited Access Amounts: The $100/day, $750/pay period limit may not be sufficient for larger emergencies.

-

Privacy Concerns: Connecting work email or enabling location tracking involves sharing significant personal data.

Chapter 6: Who is EarnIn Best For? (And Who Should Avoid It)

EarnIn is Ideal For:

-

Hourly Workers with Variable Schedules: Those whose hours fluctuate and who may have gaps in income.

-

Individuals Facing a One-Time, Short-Term Cash Gap: For a forgotten bill or minor emergency before payday.

-

People Actively Avoiding Overdrafts: Users who find the Balance Shield feature specifically valuable.

-

The “Unbanked” or “Underbanked”: Those who may use the EarnIn Express card as a primary banking tool.

-

Anyone Seeking a Payday Loan Alternative: This is the core use case.

EarnIn May Not Be the Best Fit For:

-

Individuals with Serious, Chronic Budget Shortfalls: EarnIn is a Band-Aid, not a cure for structural budget problems. It could worsen the cycle.

-

Those Who Struggle with Financial Impulse Control: Easy access could lead to using advances for non-essentials, complicating the next pay period.

-

Salaried Employees with Stable Budgets: If you have a robust budget and emergency fund, you likely don’t need this service.

-

People Uncomfortable with Data Sharing: If connecting work emails or enabling location tracking is a deal-breaker.

Chapter 7: EarnIn vs. The Competition: A Detailed Comparison

To understand EarnIn’s place in the market, we must compare it to key rivals.

1. EarnIn vs. PayActiv:

PayActiv is a major competitor that often partners directly with employers as an employee benefit. This is a key difference.

-

Access: PayActiv often allows access to all earned wages, not just a capped amount.

-

Fees: PayActiv typically charges a flat, low fee (e.g., $5 per pay period for unlimited transactions) instead of a tip model. This is often subsidized or paid by the employer.

-

Ecosystem: PayActiv integrates bill pay, savings, and financial counseling more deeply.

-

Verdict: PayActiv often provides a more comprehensive and cost-effective solution when offered through an employer. As a standalone app, EarnIn might have broader accessibility. According to a report by the Consumer Financial Protection Bureau (CFPB), employer-integrated EWA programs tend to have clearer terms and lower costs.

2. EarnIn vs. Dave:

Dave is an app that offers small cash advances ($25-$500), but it is technically an interest-free loan, not pure EWA.

-

Model: Dave uses algorithms to predict your income, not direct timesheet verification.

-

Fees: Dave has a $1 monthly subscription fee and optional express fees. No tip model.

-

Extra Features: Dave includes budgeting tools and side-gig job searches.

-

Verdict: Dave can be simpler for very small, predictable advances and has a transparent monthly fee. EarnIn is better for larger amounts directly tied to hours worked.

3. EarnIn vs. Brigit:

Brigit is similar to Dave, offering cash advances up to $250, and focuses heavily on overdraft prediction and prevention.

-

Model: Subscription-based ($9.99/month). Advances and overdraft protection are included.

-

Credit Building: Brigit offers a credit-builder loan as an add-on.

-

Verdict: Brigit is better for users who want a flat-fee, all-inclusive subscription for small advances and robust overdraft protection. EarnIn is better for those who need larger amounts and want a pay-what-you-want (or nothing) model.

Chapter 8: Safety, Security, and Regulations: Is EarnIn Trustworthy?

Security: EarnIn uses bank-level 256-bit encryption to protect user data. It does not sell personal data to third parties. However, as with any fintech app, the act of connecting financial and work accounts inherently carries a data-sharing risk.

Regulatory Landscape: The EWA industry exists in a regulatory gray area. Is it a loan or a wage access service? The distinction is crucial.

-

EarnIn’s Position: They fiercely maintain they provide a service, not a credit product, and thus should not be subject to state lending laws and interest rate caps.

-

Regulatory Scrutiny: In 2023, the New York Department of Financial Services (NYDFS) settled with EarnIn over practices related to its tip model and collections, requiring clearer disclosures. This highlights ongoing regulatory attention.

-

The Future: The Consumer Financial Protection Bureau (CFPB) is actively studying EWA products. Future regulations could shape fee structures (like tips) and consumer protections.

User Protection: EarnIn is not a bank. Funds are not FDIC-insured through EarnIn itself (though funds in the EarnIn Express account are held at FDIC-member banks). It’s vital to read their Terms of Service to understand dispute resolution and liability.

Chapter 9: Building Long-Term Financial Health: EarnIn as a Tool, Not a Solution

EarnIn is a powerful symptom reliever, but financial health requires treating the root cause. Here’s how to use EarnIn responsibly while building a stronger foundation:

-

Use It Strategically, Not Habitually: Reserve it for true, unexpected necessities, not regular spending shortfalls.

-

Budget Around Your “True” Paycheck: If you cash out $200 early, treat your upcoming payday as $200 less. Create a budget based on your net pay after advance repayment.

-

Leverage the Savings Tool: Actively use “Tip Yourself” to build a micro-emergency fund, even if it starts at $20.

-

Analyze Your Usage: If you find yourself using EarnIn every pay cycle, it’s a red flag. Conduct a deep budget audit to identify where your money is going. Resources from the National Foundation for Credit Counseling (NFCC) can provide guidance for creating a sustainable budget.

-

Seek Additional Resources: Combine EarnIn with financial education. For broader financial literacy, consider resources from trusted non-profits like myFICO’s educational blog, which offers insights into credit health, which is integral to overall financial stability.

Chapter 10: The Final Verdict and Step-by-Step Guide to Getting Started

The Final Verdict:

EarnIn is a revolutionary and largely positive force in the fintech space. It provides a critical, lower-cost alternative to payday loans and a valuable tool for avoiding overdraft fees. Its primary weakness is the opaque and potentially costly tip model, which requires user discipline. It is best used as an occasional financial bridge, not a permanent crutch. For those whose employers offer a solution like PayActiv, that may be a more stable and cheaper option. For everyone else, EarnIn is a top-tier contender in the standalone EWA app market.

How to Get Started with EarnIn (Safely):

-

Download & Sign Up: Get the app from official stores.

-

Connect Securely: Choose your verification method. Be comfortable with the data you’re sharing.

-

Set a Low or Zero Tip Policy: Decide on your tipping philosophy upfront (e.g., “I will only tip $1 if I use instant transfer” or “I will not tip on standard transfers”).

-

Enable Balance Shield: If you fear overdrafts, set this up with a reasonable safety net threshold.

-

Start Small: For your first advance, take only what you absolutely need to test the flow and repayment.

-

Monitor Your Account: Ensure funds are present for the automatic repayment on payday.

-

Evaluate: After 2-3 cycles, honestly assess if using EarnIn is improving your financial stress or masking a larger problem.

Conclusion: Taking Control in a Rigid Pay Cycle World

EarnIn represents a significant step towards democratizing access to personal earnings. It challenges an archaic payroll system and empowers workers with immediate liquidity that is rightfully theirs. While not without its controversies—particularly around its tipping and regulatory status—its net impact in reducing reliance on predatory financial products is substantial.

The ultimate power, however, remains with you, the user. Used with intention, discipline, and as part of a broader financial strategy, EarnIn can be a transformative tool for navigating the bumps of modern economic life. Used carelessly, it can become another link in a chain of financial fragility. Understand its features, know its costs, compare it to alternatives like PayActiv, and always pair it with the ongoing work of budgeting, saving, and financial education. Your financial well-being is a journey, and EarnIn can be a useful companion on the road, provided you are the one holding the map.