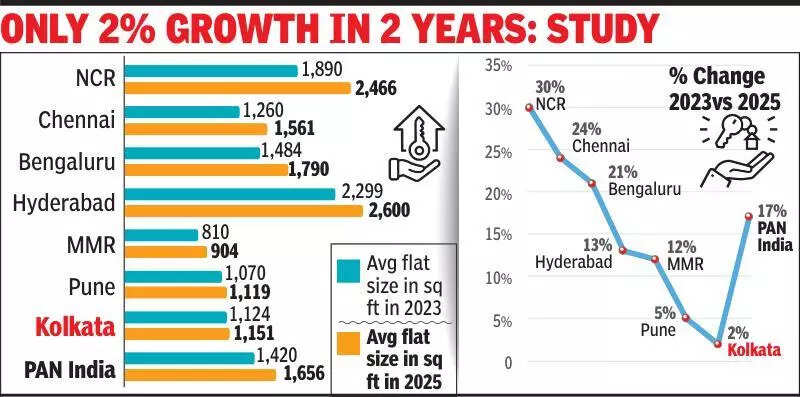

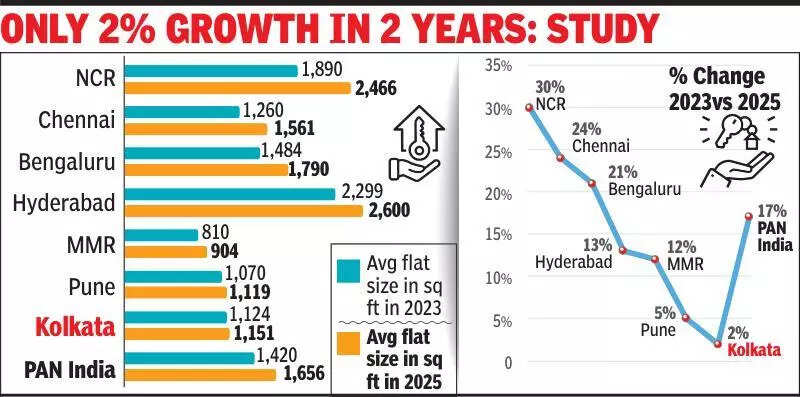

Kolkata: Average apartment sizes across India’s top 7 cities expanded 17% in 2 years, from 1,420 sq ft in 2023 to about 1,656 sq ft in 2025, as homebuyers increasingly gravitated towards larger 3-4BHK layouts, dedicated study spaces, and lifestyle-led configurations.Kolkata, however, moved in opposite direction of this national upsizing wave, registering the lowest growth among the 7 cities. Average unit size rose just 2% — from 1,124 sq ft in 2023 to 1,151 sq ft in 2025 — after already reaching 1,149 sq ft in 2024, highlighting how marginal the change was. Pune was the only other market to see single-digit growth, up 5% from 1,070 sq ft to 1,119 sq ft.This near-flat trajectory widened Kolkata’s gap versus the broader market. In 2023, Kolkata’s average home size was about 20% smaller than the top-7 average; by 2025, that difference expanded to roughly 30%, as other cities accelerated into larger formats.“The divergence is shaped by price bands and product mix. In most major markets, the sharp rise in average sizes is driven by a growing share of premium and luxury homes priced above Rs 1.5 crore, where larger configurations are standard. Kolkata remains dominated by sub-Rs 1 crore demand, with 2BHKs continuing to anchor buyer preference. Even in 2025, more than 64% of the city’s new supply of 18,590 units was in the sub-Rs 80 lakh bracket, reinforcing the affordable-to-mid segment skew that naturally limits size expansion,” said an analyst at Anarock Research that released the report.Kolkata is also essentially an end-user-driven market, whereas cities like Bengaluru saw increased investor interest in recent years after Covid. Several NRIs, for instance, hope to return to India and see the city as a viable option. Such NRIs often look for larger homes with state-of-the-art lifestyle amenities in the project. Also, several first-time homebuyers in Bengaluru seek bigger homes due to their hybrid work model. Kolkata’s average of 1,151 sq ft is not small in absolute terms for an affordable-led market and remains higher than Mumbai Metropolitan Region’s 904 sq ft while sitting close to Pune’s 1,119 sq ft. The key difference is that other cities are rapidly adding larger, premium inventory and seeing stronger demand for 3BHK, 4BHK homes.