Pre-tax profits at the operator of Intersport Elverys in 2024 declined by 7% to €6.59m, after an “exceptional” 2023 performance as a result of the 2023 Rugby World Cup.

New accounts filed by Staunton Sports Ltd show pre-tax profits fell as revenues dipped by 2% from €129.24m to €126.6m in 2024.

The directors say “the trading performance for the financial period remained very strong, with turnover of €126.6m reducing by only 2% compared to the exceptional 2023 performance in the Rugby World Cup year”.

The directors say they “are very satisfied with the trading performance”.

The firm operated 44 ‘bricks and mortar’ stores countrywide during the year, along with “a strong online presence via elverys.ie”.

The directors say “the company’s gross margin remained stable at 42.8%, supported by careful supply chain management and disciplined pricing. Inflationary cost pressures were partly offset by operational efficiencies and increased use of renewable energy sources.”

The directors say “the company remains financially robust, with net assets increasing to €38.8m and significant liquidity available through cash reserves and banking facilities”.

The accounts show that operating profits declined by 5% to €6.94m and profits reduced by net interest payments of €343,810 to €6.59m.

The firm recorded post-tax profits of €5.71m after incurring corporation tax charge of €876,990.

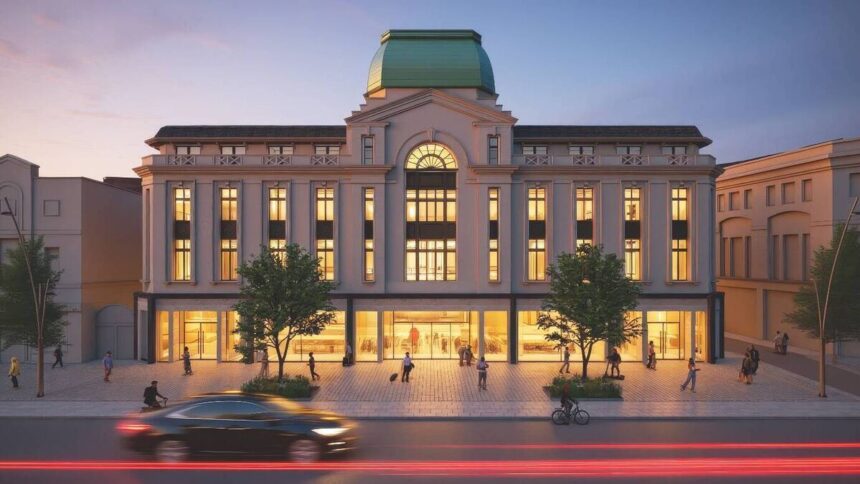

On January 28 last, Cork City Council issued a final grant of permission to connected firm, Tricondale Ltd, to redevelop the former Debenham’s Store on Cork’s St Patrick’s Street, which it purchased in May 2023 for a reported €12m.

The city council has given the green light to sub-divide the former Debenhams department store into four separate outlets.

The firm generated net cash from operations of €8.04m in 2024.

The company’s profits for 2024 take account of non-cash depreciation costs of €2.74m.

Numbers employed increased from 571 to 586, as staff costs rose from €16.39m to €17.6m.

The profits for 2024 further strengthened the group’s balance sheet, as shareholder funds increased to €38.8m, that included accumulated profits of €32.72m.

The group’s cash funds fell from €8.88m to €7.1m.

The group made payments of €3.75m to acquire property in 2024, following an outlay of €7.33m under that heading in 2023.