Can You Get a $3,000 Loan With No Credit?

-

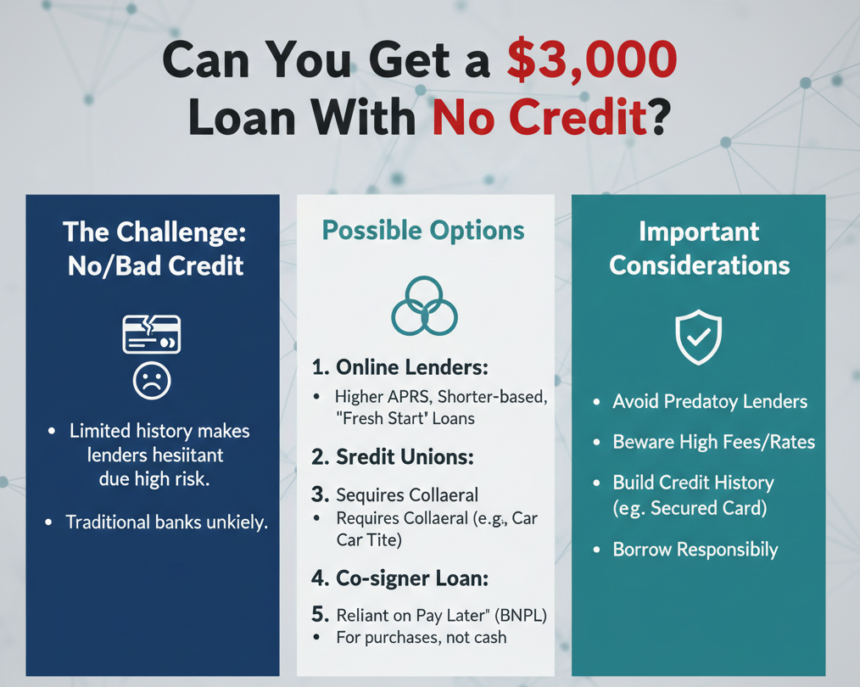

Yes, you can get a $3,000 loan with no credit. Specialized lenders and credit-building financial products exist for borrowers with limited or no credit history.

-

The trade-off is often higher costs and stricter terms. Borrowers with no credit typically face higher APRs and potential fees as lenders offset their risk.

-

Proving strong, stable income is a crucial alternative qualification. Lenders heavily weigh your debt-to-income ratio and employment history when credit data is sparse.

-

Pre-qualification and comparing multiple offers are essential. Use online tools that perform a “soft” credit check to see potential rates without harming your score.

-

Building credit before borrowing can unlock dramatically better rates. A few months of responsible credit behavior can save thousands in interest over a loan’s lifetime.

| Lender | Min. Credit Score Required | Loan Amounts (for $3k) | Key Features for No-Credit Borrowers | Potential Drawbacks |

|---|---|---|---|---|

| Oportun | No credit history required | $300 – $10,000 | Considers alternative data; same-day funding possible. | Origination fee up to 10%; APR up to 35.99%. |

| Upstart | 300 (Very Low) | $1,000 – $50,000 | Uses AI to assess education/job history. | Origination fee up to 12%; limited term options. |

| OneMain Financial | Not specified (accepts poor) | $1,500 – $20,000 | Offers secured loan option; accepts co-applicants. | High origination fees; requires in-branch visit. |

| Avant | 580 (Poor/Fair) | $2,000 – $35,000 | Next-day funding; transparent about rates. | Origination fee up to 9.99%; not for smallest loans. |

| Credit Unions | Often more flexible | Varies | Lower rates, member-focused, financial counseling. | Requires membership; may have slower funding. |

Understanding “No Credit” and How Lenders See You

When you ask about getting a loan with “no credit,” lenders typically interpret this in one of two ways: you are a “credit invisible” consumer with no accounts reported to the major bureaus (Experian, Equifax, TransUnion), or you are a “thin file” borrower with very limited credit history, such as only one reported account.

Without a traditional credit score (like a FICO Score), lenders cannot use their standard algorithms to assess risk. However, this doesn’t mean you are without options. Legitimate lenders use alternative data to build a financial profile. This can include your history of paying rent, utilities, and telecom bills on time, as well as your employment history, education, and banking activity (like consistent income deposits and low overdraft incidents).

For example, online lender Upstart is known for using artificial intelligence to consider factors like your college major, job history, and area of study, which can help applicants with insufficient credit histories qualify.

Top Lenders for a $3,000 Loan with No or Bad Credit

The market for small-dollar personal loans has grown, with several reputable lenders offering products designed for borrowers with poor or non-existent credit. Here is a detailed analysis of leading options.

1. Oportun: Best for Low Minimums & No Credit History

-

Overview: Oportun is a mission-driven lender specifically focused on serving consumers with little or no credit history. It reports to all three major credit bureaus, so timely payments can help you build credit.

-

Why it’s good for no credit: It explicitly states “no credit history required” and uses its own scoring model that incorporates alternative data.

-

Key Details:

-

APR Range: Up to 35.99%.

-

Loan Amounts: As low as $300, making it suitable for a precise $3,000 loan.

-

Fees: May charge an administrative fee of up to 10% of the loan amount.

-

Funding Speed: Most loans are funded on the same business day.

-

2. Upstart: Best for Using Alternative Data (Education/Employment)

-

Overview: Upstart’s lending platform is known for its unique model that considers more than just a credit score. It can be an excellent option for recent graduates or those new to the workforce who have a strong educational or professional background but limited credit.

-

Why it’s good for no credit: It has a minimum credit score requirement of 300 (which is very low) and its model is designed to identify creditworthy borrowers that traditional models might miss.

-

Key Details:

-

APR Range: 6.5% to 35.99%.

-

Loan Amounts: $1,000 to $50,000.

-

Fees: Charges an origination fee.

-

Funding Speed: As soon as one business day.

-

3. OneMain Financial: Best for Secured Loan Option

-

Overview: OneMain is a large, established lender with physical branches. It specializes in borrowers with poor or fair credit and offers the unique option to secure your loan with collateral (like a car) to potentially get a better rate or improve your chances of approval.

-

Why it’s good for no credit: It works with borrowers with poor credit, accepts co-applicants, and the secured loan option provides a path for those who own a vehicle.

-

Key Details:

-

APR Range: 18.00% to 35.99%.

-

Loan Amounts: $1,500 to $20,000.

-

Fees: Origination fee either a flat $25-$500 or a percentage of 1%-10%, depending on state regulations.

-

Funding Speed: Same-day funding is available.

-

Important Note: While many lenders advertise “no credit check,” this often refers to not checking traditional credit reports. They still perform financial checks. Be extremely wary of true “no-credit-check” loans like some payday or title loans, as they frequently carry predatory APRs of 300% or more and can lead to devastating debt cycles.

The Real Cost: What to Expect with a $3,000 Loan and No Credit

Borrowing without an established credit score is riskier for the lender, and that risk is reflected in the cost. It’s crucial to understand the full financial picture before committing.

-

Higher Interest Rates (APR): While someone with excellent credit might qualify for an APR under 10% on a $3,000 loan, borrowers with no credit can expect rates at the higher end of a lender’s range, often between 20% and 36%.

-

Fees: Origination fees are common and can significantly impact the amount you actually receive. For instance, a 10% origination fee on a $3,000 loan means you’d receive only $2,700, but you owe interest on the full $3,000.

-

Shorter or Less Flexible Terms: You may be offered shorter repayment periods (e.g., 24-36 months instead of 60-72 months), which results in higher monthly payments.

Let’s illustrate the cost difference. The table below compares the total cost of a $3,000 loan under different scenarios a borrower with no credit might encounter.

| Scenario | APR | Term | Monthly Payment | Total Interest Paid | Total Amount Repaid |

|---|---|---|---|---|---|

| Best-Case for No Credit | 20% | 36 months | $111.35 | $1,008.60 | $4,008.60 |

| Average-Case for No Credit | 29% | 36 months | $127.25 | $1,581.00 | $4,581.00 |

| High-Cost Loan | 35.99% | 36 months | $140.34 | $2,052.24 | $5,052.24 |

Step-by-Step Guide to Applying and Getting Approved

-

Check Your Pre-Qualification: Always start here. Most major online lenders offer a pre-qualification process that uses a soft credit inquiry, which does not affect your credit score. This allows you to see your potential rate, loan amount, and terms from multiple lenders. Platforms like Experian and LendingTree allow you to check offers from several partners at once.

-

Gather Your Documentation: Since you lack a credit score, your paperwork is vital to prove stability. Be prepared to provide:

-

Government-issued ID (Driver’s license, passport).

-

Proof of Income: Recent pay stubs (typically 1-2 months), tax returns, or bank statements showing regular deposits.

-

Proof of Residence: A utility bill, lease agreement, or similar document with your name and address.

-

Bank Account Details: An active checking account in your name is almost always required for funding and payments.

-

-

Submit a Formal Application: After choosing the best offer, you’ll complete a full application. This triggers a hard credit inquiry, which will cause a small, temporary dip in your score. You will consent to a full credit check and verify the information you provided.

-

Review and Sign the Loan Agreement: If approved, read the final agreement meticulously. Confirm the APR, monthly payment, total repayment amount, term length, and all fees. Ensure there are no hidden clauses.

-

Receive Your Funds: Funding speed varies. Some lenders like OneMain Financial or CreditNinja can offer same-day funding if you complete the process early enough, while others may take 1-3 business days.

Strategic Alternatives and Paths to Better Rates

If the terms for a no-credit loan are too expensive, consider these strategic paths, which may take a little more time but can save you significant money.

1. The Co-Signer or Co-Applicant Path

This is one of the most effective strategies. A co-signer (or co-applicant) with good credit applies for the loan with you. Their strong credit history essentially vouches for you, dramatically increasing your approval odds and potentially lowering your APR to their qualified rate. Important: The co-signer is legally equally responsible for the debt. Any missed payments will damage both credit scores.

2. The Secured Loan Path

If you own a car or other valuable asset outright, you can apply for a secured personal loan. By offering the asset as collateral, you reduce the lender’s risk, which can lead to approval and a lower interest rate. OneMain Financial explicitly offers this option. The major risk is that you could lose the asset if you default.

3. The Credit-Builder Path (Delay and Build)

This involves taking 6-12 months to build a credit profile before applying for the loan.

-

Apply for a Secured Credit Card: You deposit a cash collateral (e.g., $200) which becomes your credit limit. Use it for small purchases and pay the balance in full every month. This activity is reported to credit bureaus.

-

Become an Authorized User: Ask a family member with excellent credit to add you as an authorized user on their old, well-managed credit card. Their positive payment history can be added to your credit file.

-

Get a Credit-Builder Loan: Some community banks and credit unions offer these. The lender places the loan amount (say, $1,000) into a locked savings account. You make monthly payments, and after the term is complete, you get the money plus any interest earned, and your positive payment history is reported.

4. Exploring Alternative Sources

-

Credit Unions: As member-owned non-profits, they often have more flexibility and lower rates than big banks, especially for members with challenging credit histories.

-

Borrowing from Retirement Accounts: If you have a 401(k), you may be able to borrow against it. This doesn’t require a credit check, and you pay interest back to yourself. However, it comes with major risks, like penalties if you leave your job.

-

Family Loans: A formal, low-interest loan from family can be a solution. Crucially, draft a written agreement outlining the terms to prevent misunderstandings.

Final Checklist and Red Flags

Before You Accept Any Loan Offer:

-

I have used a pre-qualification tool to compare multiple offers.

-

I have calculated the total repayment amount (principal + all interest).

-

I have budgeted and confirmed the monthly payment fits comfortably in my finances.

-

I have read the entire agreement and understand all fees (origination, late, prepayment).

-

The lender is licensed in my state and has verifiable contact information.

Red Flags of Predatory Lenders:

-

Guaranteed Approval: No legitimate lender can guarantee approval before reviewing your application.

-

Pressure to Act Immediately: High-pressure tactics are a hallmark of scams.

-

Requests for Upfront Fees via Wire Transfer or Gift Cards: Legitimate lenders deduct fees from your loan proceeds; they don’t ask for money orders or gift cards before funding.

-

Vague or Missing Contact Information: You should be able to easily find a physical address and customer service number.

Conclusion

Yes, obtaining a $3,000 loan with no credit is possible through specialized lenders who use alternative data to assess your creditworthiness. However, this access comes at a premium in the form of higher interest rates and fees. Your most powerful tools are comparison shopping through pre-qualification and strengthening your application with proof of stable income or a qualified co-signer.

For the best long-term financial health, view your first loan as a stepping stone. By borrowing from a lender that reports to credit bureaus and making every payment on time, you can build the credit history needed to access far more affordable financing in the future. The path to good credit starts with a single, responsibly managed obligation.