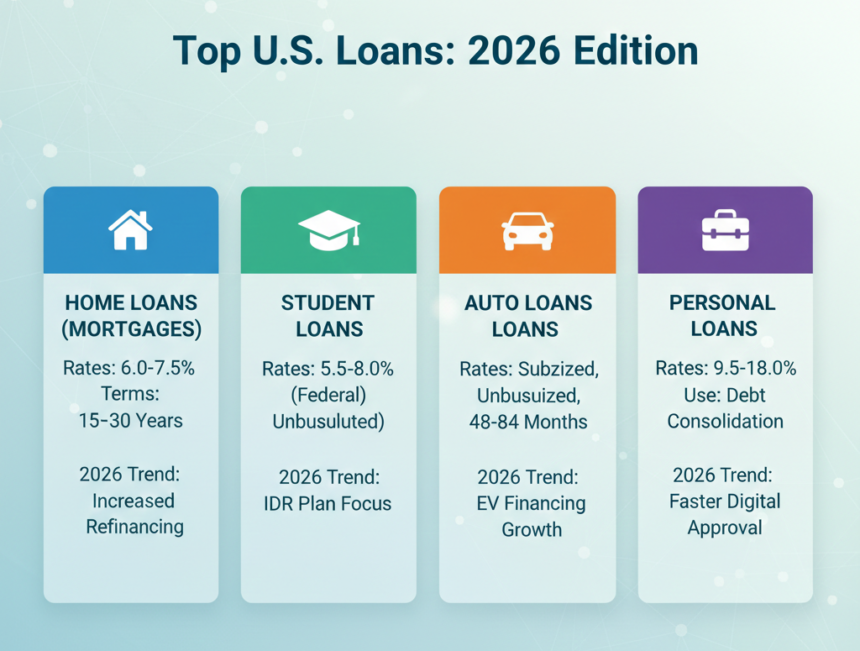

This comprehensive guide examines every facet of borrowing in today’s environment. We’ll explore the different types of loans available, current market trends, essential terminology, and strategic approaches to securing favorable terms. Whether you’re a first-time homebuyer navigating stabilized mortgage rates around 6-7%, a consumer seeking same-day personal loans, or an investor considering floating-rate loan allocations, this guide provides the insights needed to make informed financial decisions.

The loan market has transformed from the historically low rates of the early 2020s to what experts now call “the new normal” of 6% mortgage rates. Borrowers have adapted to this reality, and lending institutions have responded with innovative products and approaches. Understanding these changes is essential for anyone considering borrowing in 2026.

Key Loan Market Trends for 2026

-

Mortgage rate stabilization: Rates expected to hover between 6-7% for 30-year fixed loans

-

Increased housing inventory: Expected 9% year-over-year increase in existing home listings

-

Alternative mortgage growth: Adjustable-rate mortgages (ARMs) representing up to 10% of volume

-

Wage growth outpacing inflation: Expected 3.5% wage increase vs. 2.6% inflation

-

Technology integration: AI and automation streamlining loan processes

Section 1: Understanding the Core Elements of Loans

Every loan consists of three fundamental components that determine its structure, cost, and suitability for your financial situation. These elements work together to create the complete borrowing package, and understanding each is essential for making informed decisions.

1. Loan Type: Choosing Your Financial Instrument

Loan types define the fundamental structure and purpose of your borrowing arrangement. The Consumer Financial Protection Bureau categorizes loans primarily by their backing (conventional, government, or special program) when discussing mortgages, but this framework applies conceptually to all lending.

Conventional Loans represent the majority of lending and typically come with stricter qualification requirements but potentially lower costs for well-qualified borrowers. These are not backed by government agencies and are offered by private lenders according to their own guidelines.

Government-Backed Loans include programs like FHA (Federal Housing Administration), VA (Veterans Affairs), and USDA (U.S. Department of Agriculture) options. These often feature more flexible qualification standards, such as lower down payment requirements or more lenient credit score considerations.

Special Program Loans encompass state or local housing agency programs, special purpose credit programs, and other targeted lending initiatives designed for specific borrower groups such as first-time homebuyers, public service employees, or residents of particular communities.

2. Loan Term: The Timeline of Your Financial Commitment

The loan term—how long you have to repay the borrowed amount—profoundly impacts both your monthly payments and total interest costs. Common terms include 15-year and 30-year options for mortgages, with 24-84 month terms typical for personal loans.

Shorter terms (like 15-year mortgages) generally feature:

-

Higher monthly payments

-

Lower interest rates (often by a full percentage point or more)

-

Significantly lower total interest costs over the life of the loan

Longer terms (like 30-year mortgages) generally offer:

-

Lower monthly payments, increasing affordability

-

Higher interest rates

-

Greater total interest paid over time

The choice between terms represents a classic financial trade-off between immediate cash flow and long-term cost savings. Interestingly, discussions about ultra-long mortgages (40-50 year terms) have emerged in 2026 as potential solutions to affordability challenges, though experts caution about the significantly higher total interest costs and slower equity accumulation associated with such extended terms.

3. Interest Rate Type: Fixed vs. Variable Structures

Interest rates come in two primary forms that determine how your borrowing costs may change over time:

Fixed-Rate Loans maintain the same interest percentage throughout the entire loan term, providing predictability and protection against market rate increases. Historically, 70-95% of borrowers have chosen fixed-rate options, valuing the stability they provide.

Adjustable-Rate Loans (ARMs) begin with a fixed introductory rate for a specified period (commonly 5, 7, or 10 years), after which the rate adjusts periodically based on market indices. These typically start with lower initial rates but carry uncertainty about future payments.

Interest Calculation Methods further complicate the rate picture:

-

Simple Interest: Calculated only on the principal balance

-

Compound Interest: Calculated on principal plus accumulated interest, potentially increasing borrowing costs

-

Accrued Interest: Interest that accumulates between payments

Section 2: Comprehensive Loan Glossary

Navigating the world of loans requires fluency in its specialized language. Below are essential terms every borrower should understand, compiled from authoritative sources including the University of California’s Office of Loan Programs glossary.

| Term | Definition | Why It Matters |

|---|---|---|

| Amortization | The process of paying off debt through regular installments of principal and interest | Determines how your payments are structured between principal reduction and interest costs |

| Annual Percentage Rate (APR) | A percentage rate reflecting the total cost of credit, including interest and certain fees | Provides a more complete picture of loan cost than interest rate alone |

| Balloon Payment | A final payment significantly larger than regular installments | Can create unexpected financial strain if not planned for appropriately |

| Debt-to-Income Ratio (DTI) | Percentage of monthly gross income used to pay debts | Key qualification metric lenders use to assess repayment capacity |

| Equity | The difference between a property’s market value and the debt secured against it | Represents your ownership stake and potential borrowing collateral |

| Loan-to-Value Ratio (LTV) | The loan amount divided by the property’s appraised value | Higher ratios typically mean higher rates and required mortgage insurance |

| Private Mortgage Insurance (PMI) | Insurance protecting lenders when borrowers make down payments below 20% | Adds to monthly housing costs until sufficient equity is built |

| Underwriting | The process of evaluating a loan application to determine risk level | Determines whether you qualify and at what terms |

Bridge Loans represent another important concept—temporary financing (usually less than 12 months) used when proceeds from a sale aren’t yet available for a new purchase. These specialized instruments highlight the diversity of loan products available for specific financial situations.

Section 3: Mortgage Loans in 2026

Current Mortgage Landscape

The mortgage market of 2026 represents a period of stabilization after several years of volatility. According to industry experts, “rates are going to stabilize… in this 6% to 7% range,” creating what Matt Vernon, head of consumer lending at Bank of America, calls “the new norm”. This represents a significant shift from the sub-3% rates of the early 2020s but remains historically reasonable compared to previous decades.

Housing inventory shows promising signs of improvement, with existing home listings expected to rise nearly 9% year-over-year as the “mortgage rate lock-in effect” gradually eases. Approximately 80% of U.S. homeowners with mortgages currently have rates below 6%, down from 85% in 2025, indicating increasing willingness to sell despite higher current rates.

2026 Mortgage Trends

Several key trends are shaping the mortgage landscape this year:

-

Adjustable-Rate Mortgage Resurgence: ARMs now represent up to 10% of mortgage volume—the highest level since 2023—as borrowers seek lower initial payments.

-

Extended Term Discussions: While not yet mainstream, conversations about 40-50 year mortgages continue as potential solutions to affordability challenges, despite concerns about significantly higher total interest costs.

-

Technological Integration: Artificial intelligence and automation are increasingly streamlining mortgage processes, potentially reducing closing times and costs.

-

First-Time Buyer Programs: Specialized programs, including down payment assistance and grants, are increasingly important for entry-level buyers. For example, Bank of America offers a down payment grant program covering 3% of the purchase price (up to $10,000).

-

Non-QM Market Expansion: Non-qualified mortgage products have doubled their market share and may reach “low-teens” percentages in 2026, serving borrowers with unique financial situations.

Specialized Mortgage Products

Beyond conventional fixed-rate mortgages, several specialized products deserve consideration:

Graduated Payment Mortgages feature initial lower interest rates that gradually increase until reaching the standard rate, helping borrowers with anticipated income growth.

Interest-Only Payment Loans allow borrowers to pay only interest for a specified period before beginning principal repayment, potentially easing short-term cash flow.

Buydown Programs, increasingly offered by builders, temporarily reduce interest rates for the first few years of a mortgage.

Section 4: Personal and Consumer Loans

Same-Day Personal Loans

For urgent financial needs, several lenders now offer same-day funding. CNBC Select’s analysis of 2026 options highlights several top contenders:

| Lender | APR Range | Loan Amounts | Key Features |

|---|---|---|---|

| LightStream | 6.94% – 25.29% | $5,000 – $100,000 | No fees, same-day funding available |

| SoFi | 8.99% – 29.49% | Up to $100,000 | High borrowing limits, unemployment protection |

| Upstart | 7.80% – 35.99% | $1,000 – $75,000 | Considers applicants with limited credit history |

| Avant | 9.95% – 35.99% | $2,000 – $35,000 | Available to borrowers with scores as low as 580 |

These rapid-funding options are particularly valuable for emergency expenses, though borrowers should carefully compare terms and prioritize lenders offering prequalification without hard credit inquiries.

Strategic Uses for Personal Loans

-

Debt Consolidation: Combining higher-interest debts into a single personal loan with a lower rate can reduce monthly payments and total interest costs.

-

Home Improvements: Financing renovations that increase property value, with the potential to leverage home equity for better terms.

-

Major Purchases: Covering significant expenses like vehicles, appliances, or medical procedures while avoiding credit card interest rates.

-

Business Financing: Some personal loans can fund business needs, though specific business loans often offer better terms for commercial purposes.

Credit Considerations

Personal loan approval and rates depend heavily on creditworthiness:

-

Excellent Credit (720+) typically qualifies for the lowest advertised rates

-

Good Credit (680-719) generally secures competitive offers

-

Fair Credit (640-679) may face higher rates and some limitations

-

Poor Credit (below 640) has fewer options, often with significantly higher costs

The growing availability of loans for borrowers with limited or poor credit history represents a significant market development, though these products often carry higher costs to offset lender risk.

Section 5: Strategic Loan Selection Process

Step-by-Step Borrowing Strategy

-

Assess Your Financial Position:

-

Calculate your debt-to-income ratio

-

Check your credit reports and scores

-

Determine how much you can comfortably afford in monthly payments

-

-

Define Loan Purpose and Requirements:

-

Specify exactly what you need to finance

-

Determine the optimal loan amount (avoid overborrowing)

-

Establish your preferred repayment timeline

-

-

Research and Compare Options:

-

Explore multiple lender types (banks, credit unions, online lenders)

-

Compare both interest rates and APRs

-

Consider all fees (origination, prepayment penalties, late fees)

-

-

Get Prequalified (When Possible):

-

Use soft inquiry prequalification tools to gauge eligibility

-

Compare multiple formal Loan Estimates before committing

-

Ask lenders to explain any unfamiliar terms or conditions

-

-

Finalize and Manage Your Loan:

-

Ensure you understand all terms before signing

-

Set up automatic payments to avoid missed due dates

-

Monitor your loan balance and explore refinancing if conditions improve

-

Red Flags and Risk Mitigation

Watch for these potentially problematic loan features:

-

Prepayment penalties that charge fees for paying off loans early

-

Balloon payments requiring large lump sums at loan maturity

-

Negative amortization where payments don’t cover all interest due, increasing your balance over time

-

Interest-only periods that delay principal repayment

Always ask lenders to provide alternative Loan Estimates without these features to compare true costs.

Section 6: The Future of Lending

Technological Transformation

The lending industry continues evolving with technological integration:

-

AI-powered underwriting that can analyze complex financial situations more efficiently

-

Automated document processing reducing paperwork burdens for borrowers

-

Blockchain applications potentially increasing security and transparency in loan transactions

-

Digital mortgage platforms streamlining the entire borrowing experience

These innovations promise to make loan processes “faster, more efficient and potentially at less cost” according to industry experts.

Market Predictions and Strategic Implications

Looking beyond 2026, several developments seem likely:

-

Increased Product Specialization: Loans tailored to specific demographic groups, professions, or financial situations.

-

Greater Integration with Financial Ecosystems: Loans becoming components of broader financial wellness platforms.

-

Enhanced Regulatory Frameworks: Evolving guidelines for emerging lending technologies and products.

-

Continued Globalization of Lending Markets: Increased cross-border borrowing opportunities and challenges.

Investment Perspective on Loans

From an investor standpoint, “loans offer a differentiated return profile: income that is contractually assured with limited duration exposure”. The floating-rate nature of many loan investments makes them particularly attractive in environments with “persistent inflation and rate uncertainty”.

Morgan Stanley’s analysis suggests that loans represent “not merely a tactical opportunity, but a strategic allocation well suited to a more complex and less forgiving market regime”. This institutional perspective highlights how loans function not just as consumer products but as investment vehicles within broader portfolios.

Conclusion: Navigating the Loan Landscape with Confidence

The world of loans in 2026 presents a balanced picture of challenges and opportunities. While interest rates have stabilized above the historic lows of previous years, they remain reasonable in historical context. More importantly, increased product variety, technological improvements, and greater market transparency empower borrowers to make more informed decisions than ever before.

Successful borrowing now requires:

-

Understanding the three core loan elements (type, term, interest structure)

-

Mastering essential loan terminology

-

Comparing multiple offers using standardized Loan Estimates

-

Considering both immediate affordability and long-term costs

-

Recognizing and avoiding potentially risky loan features

Whether seeking a mortgage in a stabilizing housing market, a personal loan for urgent needs, or exploring loans as investment vehicles, today’s borrowers benefit from unprecedented access to information, tools, and options. By approaching the borrowing process strategically and knowledgeably, you can secure loan products that genuinely support your financial goals rather than complicating them.

The most successful borrowers of 2026 will be those who invest time in education, preparation, and comparison. As Matt Vernon emphasizes, “Preparation is key in any mortgage market, but especially the one that we’re in today”. This principle applies equally to all forms of borrowing in our current financial landscape.