Federal Student Loans ! The landscape of federal student loans is undergoing its most significant transformation in decades. Beginning July 1, 2026, sweeping changes implemented through the One Big Beautiful Bill Act (OBBBA) will fundamentally alter how millions of Americans finance their education and repay their debts. This comprehensive legislation, passed by Congress in July 2025, touches every aspect of the federal student loan system—from borrowing limits and loan availability to repayment plans and forgiveness programs.

For current students, prospective borrowers, graduates in repayment, and parents navigating college financing, understanding these changes isn’t just helpful—it’s essential for making informed financial decisions that will impact families for years to come. The clock is ticking for those who wish to “grandfather” themselves into current, more flexible loan programs, with specific deadlines fast approaching.

This definitive guide synthesizes information from multiple authoritative sources to provide the clearest possible roadmap through the complex changes affecting federal student loans in 2026 and beyond. Whether you’re an undergraduate just starting college, a graduate student considering advanced degrees, a parent helping finance education, or a borrower navigating repayment, you’ll find actionable information here to guide your next steps.

Understanding the One Big Beautiful Bill Act (OBBBA)

The One Big Beautiful Bill Act represents a comprehensive overhaul of federal student lending, addressing concerns about rising student debt, program sustainability, and repayment complexity. Passed with bipartisan support in July 2025, the legislation reflects a philosophical shift toward capped borrowing, simplified repayment options, and stricter limits on loan forgiveness.

Key motivations behind the legislation include:

-

Addressing unsustainable debt growth: With over 12 million borrowers either delinquent or in default (more than 1 in 4 federal student loan borrowers), lawmakers sought to create a more sustainable system.

-

Simplifying repayment options: The previous “maze” of income-driven repayment plans created confusion and administrative complexity.

-

Controlling program costs: The unlimited borrowing previously available through PLUS loans was deemed financially unsustainable.

-

Encouraging institutional accountability: By capping federal loans, policymakers hope to pressure colleges to control costs rather than passing them on to students and taxpayers.

The changes are being implemented in phases, with the most significant provisions taking effect on July 1, 2026. This gives borrowers a limited window to take advantage of current rules before the new system becomes fully operational.

The End of an Era: SAVE Plan Termination and Its Impact

One of the most immediately impactful changes for current borrowers is the termination of the Saving on a Valuable Education (SAVE) Plan. In December 2025, the U.S. Department of Education announced a proposed settlement agreement to end this popular Biden-era repayment program.

The SAVE plan, which offered monthly payments as low as $0 for low-income borrowers and fast-tracked loan forgiveness pathways, faced legal challenges from Republican state attorneys general who argued the administration exceeded its authority in creating the program. The settlement, pending court approval, would end the long legal battle by ending SAVE itself.

“For people that made other financial decisions based on what they thought their payment was gonna be on the SAVE plan—they’re in trouble,” says Betsy Mayotte, founder of the Institute of Student Loan Advisors. “A payment plan has never been challenged in court and has never been pulled out from existing borrowers”.

Approximately 7 million borrowers currently enrolled in SAVE will need to transition to other repayment plans. This creates particular complications for those working toward Public Service Loan Forgiveness (PSLF), whose progress toward forgiveness was effectively paused during SAVE’s legal troubles.

Complete Breakdown of New Borrowing Limits

The OBBBA introduces significant caps on federal student borrowing, particularly affecting graduate and professional students. These changes mark a dramatic shift from the previous system where students could borrow up to their full cost of attendance through PLUS programs.

Graduate Student Borrowing Limits (Effective July 1, 2026)

| Loan Type | Annual Limit | Lifetime Limit | Notes |

|---|---|---|---|

| Direct Unsubsidized Loans | $20,500 | $100,000 | Available to most graduate students |

| Grad PLUS Loans | ELIMINATED for new borrowers | ELIMINATED | Phased out starting July 1, 2026 |

Professional Student Borrowing Limits (Effective July 1, 2026)

| Loan Type | Annual Limit | Lifetime Limit | Notes |

|---|---|---|---|

| Direct Unsubsidized Loans | $50,000 | $200,000 | For M.D., J.D., D.D.S. programs |

| Grad PLUS Loans | ELIMINATED for new borrowers | ELIMINATED | Phased out starting July 1, 2026 |

Undergraduate and Parent Borrowing Changes

| Borrower Type | Change | Annual Limit | Lifetime Limit |

|---|---|---|---|

| Undergraduate Students | Subsidized/Unsubsidized limits unchanged | Varies by year | Varies by dependency status |

| Parent PLUS Loans | New caps implemented | $20,000 | $65,000 per child |

The impact of these changes cannot be overstated. Graduate students attending programs with costs exceeding $20,500 annually will face significant funding gaps. “Students are gonna have to make up that gap with some other type of funding,” warns Persis Yu of Protect Borrowers, “and many students are gonna have to turn to the private student loan market”.

The Grandfathering Provision: Your Window to Current Rules

A critical aspect of the OBBBA is the “grandfathering” provision that allows certain borrowers to continue accessing current loan limits and programs. Understanding and potentially utilizing this provision could mean accessing tens of thousands more in federal loans with more flexible repayment terms.

Who Qualifies for Grandfathering?

To be eligible for grandfathering under current (pre-July 2026) rules, you must meet these criteria:

-

Have borrowed a federal Direct Loan (Subsidized, Unsubsidized, or PLUS) for your current academic program before July 1, 2026

-

Remain enrolled in the same academic program through at least June 30, 2026

-

Continue borrowing for the same degree program without interruption

How Long Does Grandfathering Last?

The grandfathering period extends for the shorter of these two periods:

-

Three additional academic years beyond July 1, 2026

-

The remaining time needed to complete your current degree based on your program’s minimum length

Strategic Considerations Before the Deadline

If you’re currently enrolled in a program and anticipate needing loans above the new caps, you may want to consider borrowing before July 1, 2026, to lock in current limits. Columbia University recommends that students who believe they’ll need loans above the new caps complete these steps by April 1, 2026:

-

Submit the 2025-2026 FAFSA

-

Complete Loan Entrance Counseling

-

Sign the Master Promissory Note for Direct Unsubsidized Loans

-

Accept Direct Unsubsidized Loan funding through your school’s financial aid portal

This strategic borrowing allows you to access current borrowing limits rather than being restricted to the new caps taking effect on July 1, 2026.

The New Repayment Landscape: From Many Plans to Two

The OBBBA dramatically simplifies the federal student loan repayment system by consolidating numerous income-driven repayment plans into just two primary options. This represents a fundamental shift from the “confusing maze of options” that previously existed.

Phasing Out of Current Income-Driven Repayment Plans

| Plan | Status for New Borrowers After July 1, 2026 | Status for Current Borrowers |

|---|---|---|

| SAVE Plan | Not available | Transitioning to other plans |

| Pay As You Earn (PAYE) | Phasing out by mid-2028 | Available until phase-out |

| Income-Contingent Repayment (ICR) | Phasing out by mid-2028 | Available until phase-out |

| Income-Based Repayment (IBR) | Remains available | Remains available |

The New Standard Repayment Plan

Beginning July 1, 2026, the new Standard Plan offers a fixed payment schedule similar to a traditional mortgage:

-

Repayment terms ranging from 10 to 25 years based on loan balance

-

Equal monthly payments covering principal and interest

-

No income calculation required—payments are fixed regardless of earnings

This plan will likely work best for borrowers with stable incomes who prefer predictable payments and want to minimize total interest paid over the life of their loans.

Introducing the Repayment Assistance Plan (RAP)

The Repayment Assistance Plan (RAP) becomes the primary income-driven option for both new and existing borrowers starting July 1, 2026. Key features include:

-

Income-based payments: Typically 10-15% of discretionary income (exact formula TBD)

-

Interest subsidy: The government waives any interest not covered by your monthly payment

-

Principal protection: For payments under $50, the government matches borrower payments toward principal

-

Extended forgiveness timeline: 30 years for most borrowers (vs. 20-25 under previous plans)

“Borrowers with typical levels of debt and typical incomes for their degree level are almost always gonna pay off well before they hit that 30-year mark,” notes Preston Cooper of the American Enterprise Institute. “So if you’re going into RAP, I wouldn’t be thinking about forgiveness because you’re probably gonna pay it off”.

Critical Deadline for Current Borrowers

Current borrowers who wish to preserve access to an income-driven repayment plan need to act by July 1, 2028. By switching to the Income-Based Repayment (IBR) plan before this deadline, you can preserve forgiveness options after 25 years rather than the new 30-year timeline under RAP.

Public Service Loan Forgiveness: New Restrictions and Considerations

The Public Service Loan Forgiveness (PSLF) program, which forgives remaining debt after 10 years of qualified public service employment, faces significant regulatory changes effective July 1, 2026.

Key Changes to PSLF Eligibility

-

Employer restrictions: Workers whose government or nonprofit employers engage in activities with a “substantial illegal purpose” may be denied forgiveness

-

Definition authority: The Education Secretary determines what constitutes “substantial illegal purpose”—a controversial provision currently being challenged in court

-

Ongoing program: Despite changes, PSLF remains one of the few forgiveness pathways not affected by the new taxability rules (see below)

Strategic Considerations for Public Service Workers

-

PSLF Buyback option: Borrowers can make lump-sum payments for periods that wouldn’t normally count toward PSLF (such as the SAVE plan administrative forbearance period)

-

Documentation is critical: Meticulously track employment certification and payments, especially during program transitions

-

Legal challenges ongoing: Multiple cities have sued over the new “substantial illegal purpose” provision, so further changes are possible

Liz Kilty, an oncology nurse in Portland, Oregon, exemplifies the challenges borrowers face: “I’ve been waiting a decade [for forgiveness] and now things could go awry, and you’re just helpless”. Kilty has since applied for the PSLF Buyback to make her remaining 15 payments in one lump sum.

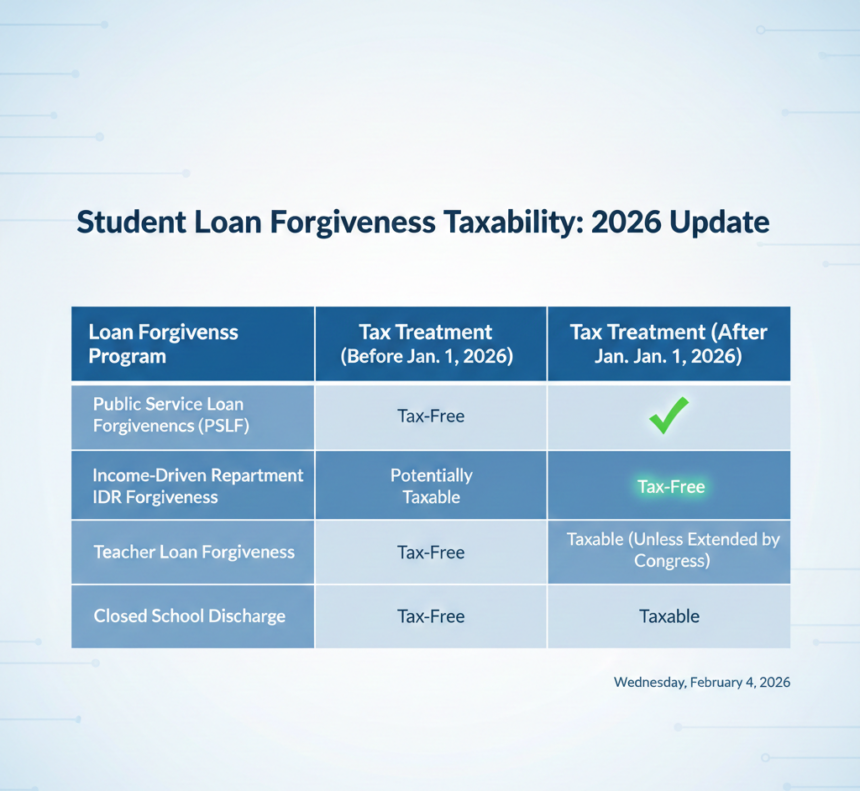

Tax Implications of Loan Forgiveness in 2026

A significant but less-discussed change affecting borrowers is the expiration of tax-free treatment for most student loan forgiveness. The American Rescue Plan Act provision that excluded forgiven student loan debt from taxable income expired on January 1, 2026.

What This Means for Borrowers

-

IDR forgiveness now taxable: Borrowers who receive forgiveness through income-driven repayment plans after January 1, 2026, may owe taxes on the forgiven amount as if it were income

-

PSLF remains tax-free: Public Service Loan Forgiveness is explicitly excluded from these tax implications

-

Potential for substantial tax bills: Some borrowers could face tax bills as high as $10,000 on forgiven amounts

Protection for Some Borrowers

A preliminary agreement between the Department of Education and the American Federation of Teachers provides some relief: the department will not file 1099-C forms for borrowers who qualified for forgiveness before January 1, 2026, but experienced processing delays due to ED’s backlog.

“NASFAA is relieved to see protections for borrowers who, through no fault of their own, faced Department of Education processing delays that pushed their forgiveness into a taxable year,” said Megan Walter, NASFAA senior policy analyst.

The Return of Collections and Default Management

After a period of relaxed enforcement, the Department of Education has announced it will resume involuntary collections on defaulted federal student loans in early 2026. However, this resumption has been temporarily delayed to allow for implementation of the OBBBA repayment reforms.

New Protections for Defaulted Borrowers

The Working Families Tax Cuts Act (part of the broader OBBBA reforms) includes these borrower-friendly provisions:

-

Second chance at rehabilitation: Borrowers now have an opportunity to rehabilitate a defaulted loan a second time (previously only one rehabilitation was allowed)

-

Additional time to avoid collections: The delay in collections gives defaulted borrowers more time to explore new repayment options

-

Simplified return to repayment: Consolidation and rehabilitation processes are streamlined under the new system

The Scale of the Default Challenge

Current data reveals a troubling picture of borrower distress:

-

5.5 million borrowers are currently in default

-

3.7 million borrowers are more than 270 days late on payments

-

2.7 million borrowers are in early stages of delinquency

-

Total: Approximately 12 million borrowers (more than 1 in 4) are either delinquent or in default

Persis Yu of Protect Borrowers warns America is at “the precipice of a default cliff,” while Betsy Mayotte adds, “I really do think we’re headed for historic default rates, for a while”.

Strategic Guide for Different Borrower Categories

Your specific situation determines which changes matter most and what actions you should consider. Here’s tailored guidance for different borrower profiles:

For High School Students and Families (College Starting Fall 2026+)

-

Maximize gift aid first: Scholarships and grants don’t require repayment

-

Understand the new Parent PLUS limits: $20,000/year and $65,000 total per child

-

Complete FAFSA early: New exclusions for family farms and small businesses in asset calculations

-

Develop a multi-year funding plan: Account for all four years within the new caps

-

Explore 529 plans and education savings accounts: Tax-advantaged options unaffected by federal changes

For Current Undergraduate Students

-

Consider strategic borrowing before July 2026: If you’ll need Parent PLUS loans exceeding new limits, borrowing before the deadline locks in current rules

-

Monitor your borrowing against new lifetime limits: Even though annual limits are unchanged, there’s a new overall lifetime limit

-

Graduate on time: Extending your program could push borrowing into the new restrictive system

-

Research graduate program financing early: If considering advanced degrees, understand the dramatically reduced borrowing limits you’ll face

For Graduate and Professional Students

-

ACT BEFORE JULY 1, 2026: This cannot be overstated. Borrowing even $1 in federal loans before this date grandfathers you into current, more generous limits

-

Calculate your total program costs: Compare against new caps ($20,500/year for graduate, $50,000/year for professional)

-

Develop alternative funding strategies:

-

University assistantships and fellowships

-

Employer tuition assistance programs

-

Private student loans (with careful comparison shopping)

-

Extended program timelines to work while studying

-

-

Consider program affordability: Some high-cost programs may become financially inaccessible under the new limits

For Borrowers Currently in Repayment

-

Evaluate your repayment plan options before July 2028: If you want to preserve 20-25 year forgiveness timelines, switch to IBR before the deadline

-

Use the Loan Simulator: The Department of Education’s tool helps compare plans

-

Consider consolidation strategically: May help access new repayment options but resets forgiveness timelines

-

Document everything: Especially if pursuing PSLF or other forgiveness programs

For Parents Financing Education

-

Understand the new Parent PLUS caps: $20,000/year, $65,000 total per child

-

Explore co-borrowing options: Some private lenders offer parent-student shared responsibility loans

-

Consider home equity alternatives: Often lower rates but with different risk profile

-

Communicate clearly with your student: Set realistic expectations about what you can contribute

Private Student Loans: Filling the Gap

With federal loan options becoming more restrictive, private student loans will play an increasingly important role in education financing. However, they differ significantly from federal loans and require careful consideration.

Key Differences Between Federal and Private Loans

| Feature | Federal Loans | Private Loans |

|---|---|---|

| Interest rates | Fixed by Congress | Variable or fixed, based on credit |

| Repayment flexibility | Multiple plans, deferment, forbearance | Limited options, lender-dependent |

| Forgiveness programs | PSLF, IDR forgiveness | Generally none |

| Credit requirements | Minimal for most loans | Good credit or cosigner typically required |

| Loan discharge | In cases of death/disability | Varies by lender |

Tips for Considering Private Loans

-

Exhaust federal options first: Always maximize federal borrowing before turning to private loans

-

Shop around: Compare multiple lenders on rates, fees, and terms

-

Understand cosigner implications: Most students need cosigners; understand release requirements

-

Consider credit impact: Multiple applications within a short period count as a single inquiry

-

Read the fine print: Understand deferment options, prepayment penalties, and variable rate risks

Columbia University maintains a suggested private lender list, acknowledging that “lenders are adjusting their products in response to increased borrowing needs” under the new federal limits.

International Study Considerations

American students studying abroad face particular complexities under the new rules. Universities like Oxford and Aberdeen provide detailed guidance for U.S. federal loan recipients.

Key Considerations for International Study

-

Program eligibility: Not all international programs qualify for U.S. federal loans

-

Enrollment requirements: Typically must be at least half-time in a degree program

-

Geographic restrictions: Generally limited to 25% of study outside the host country

-

School certification: The international institution must complete U.S. Department of Education paperwork

-

Currency considerations: Loans are in U.S. dollars but expenses may be in local currency

Strategic Implications of the 2026 Changes

-

Grandfathering applies: If you received federal loans for your international program before July 1, 2026, you’re likely grandfathered

-

Professional program definition: U.S. definitions (M.D., J.D., D.D.S.) apply regardless of where you study

-

Higher cost challenges: Many international programs have costs exceeding new federal caps, requiring more private financing

Looking Ahead: The Future of Student Lending

The 2026 changes represent a philosophical shift in federal student lending, but they’re unlikely to be the last word on the subject. Several factors suggest continued evolution:

-

Legal challenges ongoing: Multiple provisions face court challenges that could modify implementation

-

Political dynamics: Future administrations or Congresses may modify aspects of the OBBBA

-

Market responses: Colleges may adjust pricing or aid policies in response to borrowing caps

-

Innovation in private lending: New products may emerge to fill gaps left by federal restrictions

-

State-level initiatives: Some states may expand their own student aid programs

“I got a bad feeling in the pit of my stomach when this law went through because I don’t think it’s gonna lower the cost of education like members of Congress think that it might,” says Betsy Mayotte of TISLA. This sentiment reflects broader concerns about unintended consequences of the reforms.

Conclusion and Action Plan

The 2026 changes to federal student loans represent the most significant overhaul in a generation. While the new system aims to address legitimate concerns about debt sustainability and program complexity, it creates immediate challenges for borrowers at all stages of their educational journeys.

Your Essential Action Items

Based on your situation:

IF YOU’RE A CURRENT STUDENT (before July 1, 2026):

-

Determine if you need to borrow before the deadline to grandfather into current rules

-

Complete necessary steps (FAFSA, counseling, MPN) by April 1, 2026, to ensure processing

-

Consult your financial aid office for personalized guidance

IF YOU’RE STARTING AFTER JULY 1, 2026:

-

Develop a comprehensive financing plan that accounts for new borrowing limits

-

Maximize scholarships, grants, and work-study

-

Research private loan options early

-

Consider cost when selecting programs

IF YOU’RE IN REPAYMENT:

-

Use the Loan Simulator to compare repayment options

-

Consider switching to IBR before July 2028 if you want to preserve 25-year forgiveness

-

Document everything if pursuing PSLF

-

Prepare for potential tax implications if receiving IDR forgiveness after 2026

IF YOU’RE A PARENT:

-

Understand the new Parent PLUS limits ($20,000/year, $65,000 total)

-

Explore college payment plans and private lending options

-

Have realistic conversations with your student about affordability

Final Thoughts

Navigating the new student loan landscape requires proactive planning and informed decision-making. While the changes create challenges, they also force a more deliberate approach to financing education—one that considers return on investment, minimizes unnecessary borrowing, and encourages completion.

As Under Secretary of Education Nicholas Kent stated, “The law is clear: if you take out a loan, you must pay it back”. The 2026 reforms make this reality more explicit than ever, reducing back-end forgiveness while limiting front-end borrowing.

By understanding these changes and planning accordingly, borrowers can make the most of available resources while minimizing financial stress during and after their educational journeys. The key is starting early, asking questions, and making decisions based on complete information about both current options and the changing landscape ahead.

Additional Resources:

-

Federal Student Aid Official Website – The definitive source for federal loan information

-

Institute of Student Loan Advisors – Nonprofit providing free student loan advice

-

Consumer Financial Protection Bureau Student Loans – Objective information on all education financing options