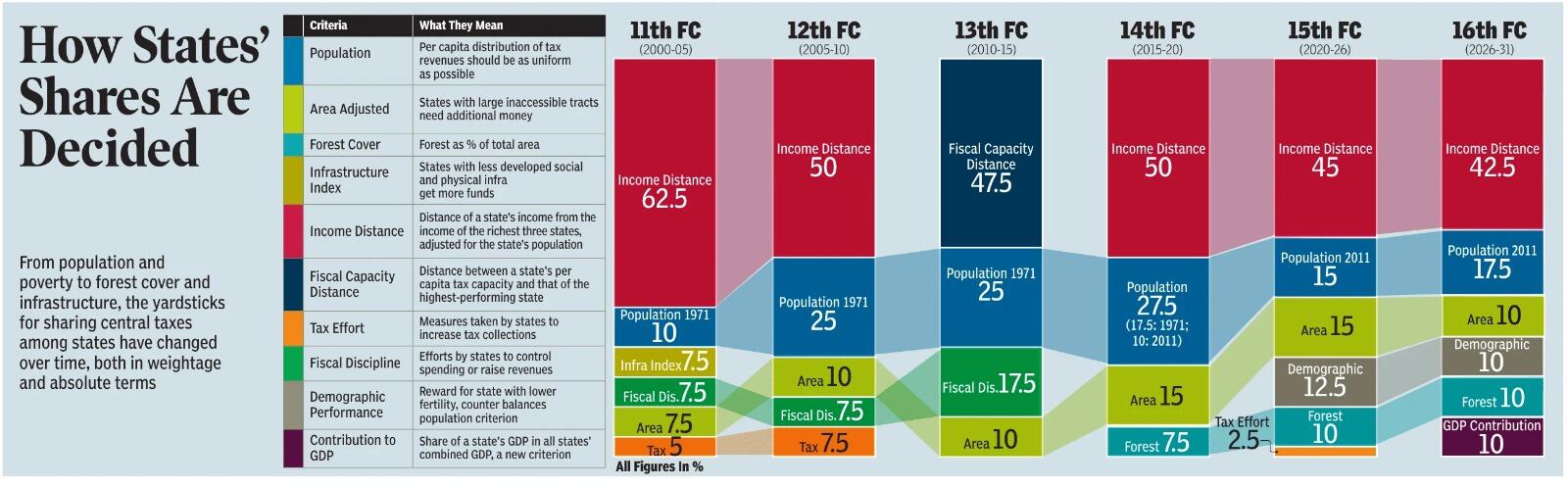

NEW DELHI: The yardsticks used to determine how central tax revenues are shared among states have undergone significant changes over the years, with successive Finance Commissions shifting weight from population and poverty-based indicators to broader measures such as fiscal capacity, demographic performance, forest cover and, most recently, contribution to GDP. An overview of Finance Commission recommendations from the 11th to the 16th shows a gradual rebalancing of priorities, reflecting changing economic realities and policy concerns. While income distance — a measure of how far a state’s income is from that of the richest states — has remained the single largest criterion, its weight has steadily declined from 62.5% in the 11th Finance Commission to 42.5% in the 16th. Population has continued to play a central role, though the reference year has evolved. Early commissions relied solely on the 1971 Census to avoid penalising states that had successfully controlled population growth. From the 14th Finance Commission onwards, the 2011 Census was partially introduced, and by the 15th and 16th Commissions, population figures from 2011 gained greater prominence, with weights of 15% and 17.5%, respectively.

The 13th Finance Commission marked a key shift by replacing income distance with fiscal capacity distance, assigning it a weight of 47.5%. This measure assesses the gap between a state’s per capita tax capacity and that of the best-performing state, aiming to better reflect revenue-raising ability. Other criteria have been gradually added or strengthened. Area, which recognises the higher cost of providing services in geographically large or difficult regions, rose from 7.5% in the 11th Commission to 15% in the 14th and 15th, before being reduced to 10% in the 16th. Forest cover, introduced later, now accounts for 10% of the weightage, acknowledging the ecological services provided by forest-rich states. Demographic performance was introduced by the 15th Finance Commission with a weight of 12.5% to reward states that achieved lower fertility rates and better population control. The 16th Commission has retained this criterion, assigning it a 10% weight. In a notable addition, the 16th Finance Commission has included “contribution to GDP” as a new parameter, allocating it a 10% weight. The move has triggered debate, particularly among poorer states, over whether it could tilt resource allocation towards economically stronger regions. Tax effort and fiscal discipline, which assess how effectively states mobilise revenue and manage expenditure, featured more prominently in earlier commissions but have seen reduced emphasis in recent years. The evolving framework highlights the Centre’s attempt to balance equity with efficiency — ensuring poorer states receive adequate support while also recognising performance, demographic outcomes and economic contribution in the distribution of national resources.